Well, thank you, sweet Baby Jesus:

That in itself constitutes a heartwarming, complete post, but I’ll augment it with some charts.

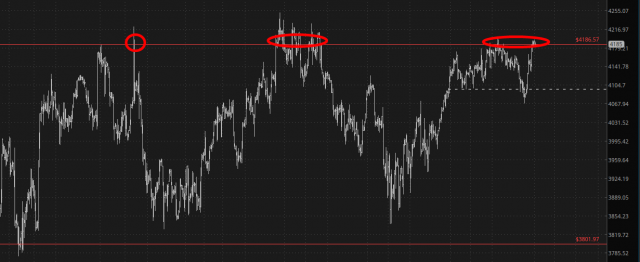

What can I say? For the umpteenth time over the past half year, we’re just banging around the 4200 level. If history is any guide, this is a foolhardy place to be buying stocks. In case you haven’t noticed, there are plenty of fools to go around, though.

In fact, equities have been so strong that the /NQ actually managed to reach escape velocity and push past even its highest point in April. At the moment, it has softened up a little and is back at the top of the same zone it has been in for weeks. The ridiculous Thursday/Friday surge got us there.

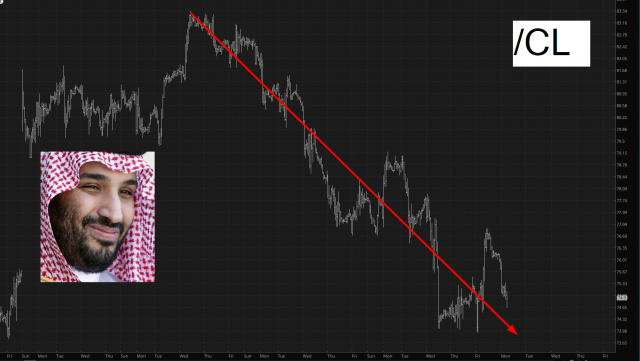

Once again, the one place of encouragement remains energy. After the OPEC+ shocker about a month ago (see giant price gap, just to the left of the hideous devil-face), the entirety of the artificial rise has been blown to hell, and we’re well BELOW the price when the OPEC+ cartel turned off all that spigots and told all their customers to pound sand. It’s pretty gratifying to see energy stocks struggling. Crude oil, as I mention every time, is simply anticipating the horrid world economy that’s forthcoming.

I see that the public is chattering about, gosh and golly gee, a recession might just be coming. Huh? You’re already in it! Deep in it! And it’s going to be a-ma-zing. I’m sure the government will let us know about it about a year after it got going.

Anyway, it’s good to see red on the screen, although I’m coming into the day fairly light. I’ve got 20 bearish positions and about 25% cash. I’m going to hold back a while before I start getting more aggressive. This market is less trustworthy than ever.