“Sell in May and go away,” my ass.

To be honest, it should have been crystal clear when I got the special “Interim Bulletin” from the boys in Gainesville two days ago. Any time the market really seems like it’s totally done and will enter a free-fall, they send out one of these things. It only happens once or twice a year, but I don’t think any of them have ever preceded anything except another rally.

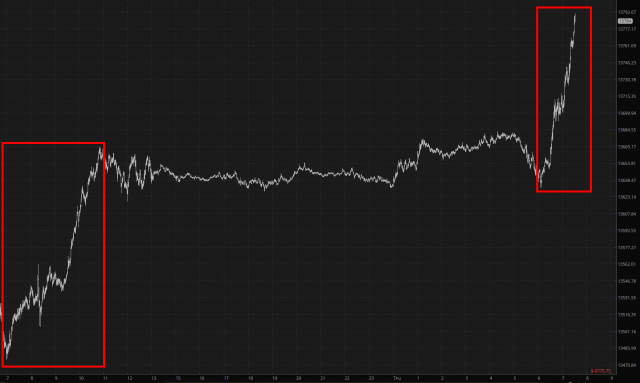

So what has transpired in the two days since then was predictable……….

To be candid, I am in full-on “f_ck THIS” mode and have a full one-third of my portfolio is plain old boring cash. The Sword of Damocles, in the form of this stupid debt ceiling kabuki theatre, is hanging over my head. I don’t want to blink and see the /ES is up 100 just because this pathetic country has allowed itself to go another several trillion dollars in debt that will never be repaid.

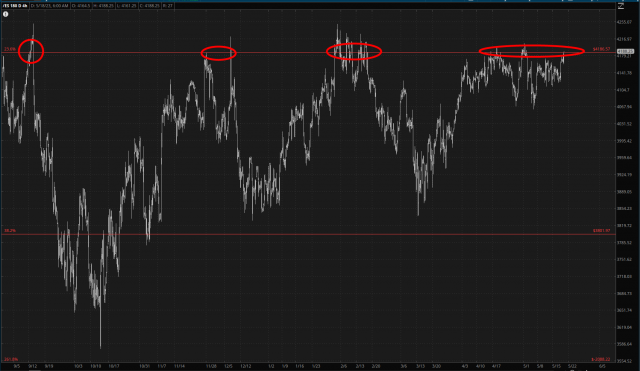

Naturally, with me so disgusted, it’s probably the perfect time to put 100% of one’s assets into nothing but index puts. (I kid, I kid). We can see that, for the billionth time, we are mashed up against the Fibonacci level which has served so well as resistance.

For myself, I have been a retreat, dumping ANY position that had even a modest loss. I am thus left with a mere 15 positions with options that expire from 92 to 246 days out, and, as I said, 33% risk-free cash.