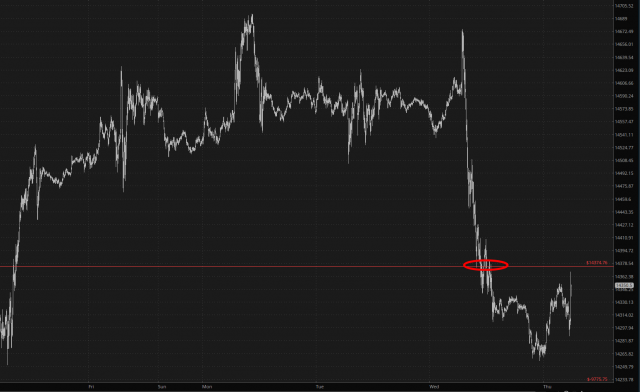

Well here we meet again. Yesterday, the /NQ was kind enough to offer a tidbit of some excitement as it fell fairly consistently and managed to cracked its Fibonacci level of 14,374.76. I see we’re taking a lunge at it now, and it will be worth noting if that line manages to hold for the day.

Throughout the course of 2023, the market has done very little but go up. February provided some weakness, but that was really the only time the bulls have had to struggle even a tiny bit. On the whole, the big tech stocks are up about 50% in the span of a few months.

We haven’t looked at the MICE chart in a while (which is equities divided by interest rates), but the failure of this multi-decade channel is fairly profound. In a few trading days, we’ll be in the throes again of interest rate volatility, and as crazy as it sounds, I think interest rates are going to head even higher (which will push MICE lower).

I continue to be exceptionally light, with over 30% cash and a mere ten positions. My watch lists have lightened up quite a lot as well, since I did a cleaning-house of my Bear Pen, which is down to just 20 securities. Good luck out there!