Note: This post is special enough to be labeled a premium post, which means that it is (with the exception of the paragraph you are reading now) visible only to Gold and Platinum subscribers. If you would like to try a risk-free subscription to get immediate access to all premium content, as well as the dozens of other features exclusive for paid accounts, click here to learn about your choices. Everyone is welcome to continue chatting in comments below (or, for a more free-flowing experience, please use SlopeTalk).

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

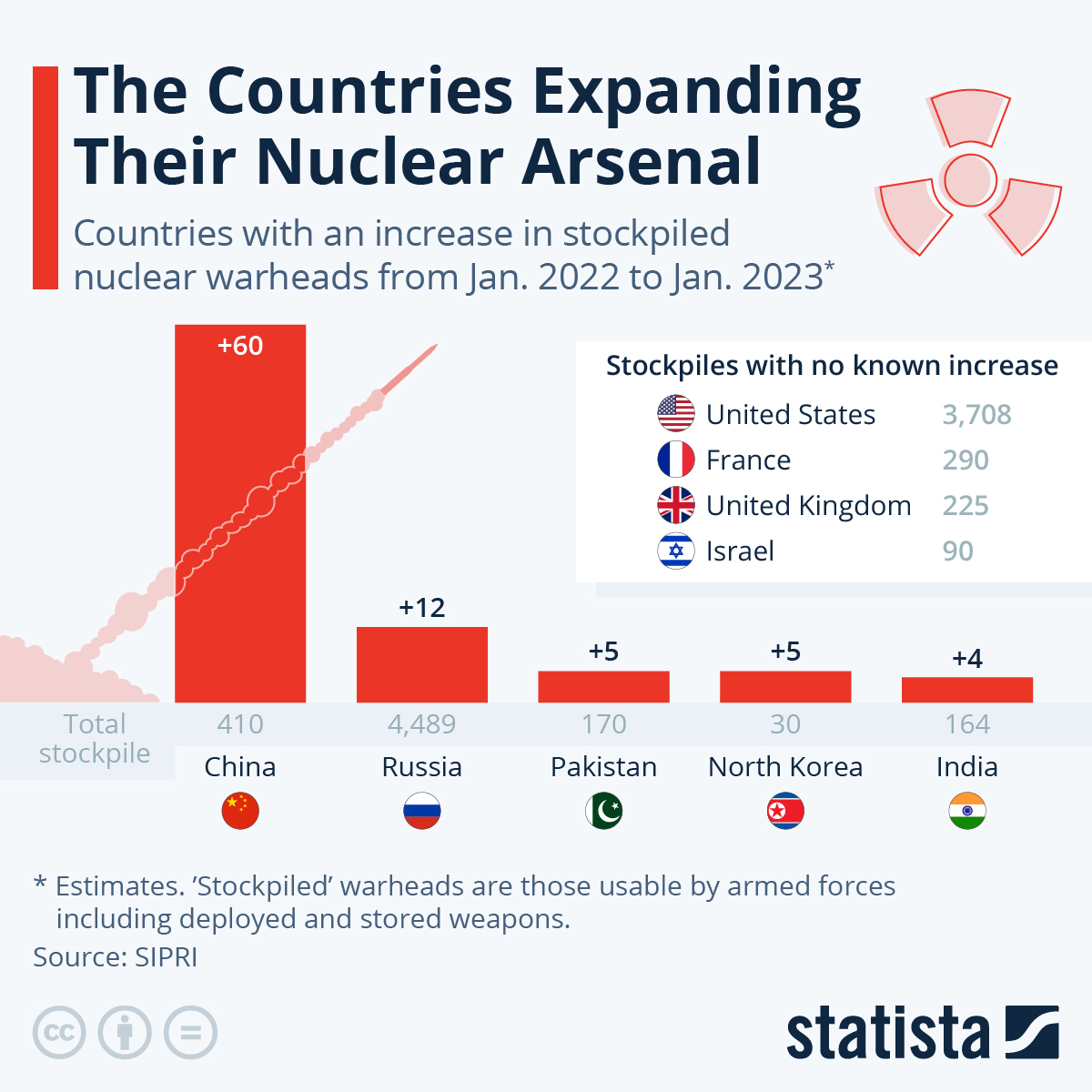

Made in China

Pre-CPI Musings

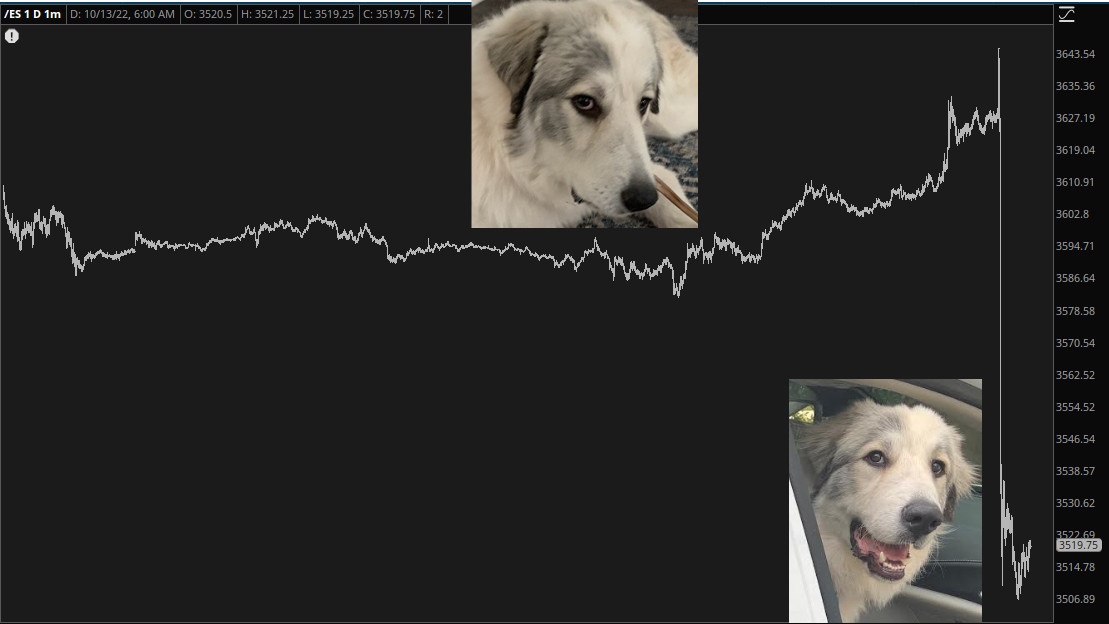

The market is a cruel, cruel mistress, but surely the cruelest in years (for me, at least) was the plunge the market took on October 13th on the heels of the hot CPI report.

Triumph Predicted It

Pre-Earnings Ideas (by The Director)

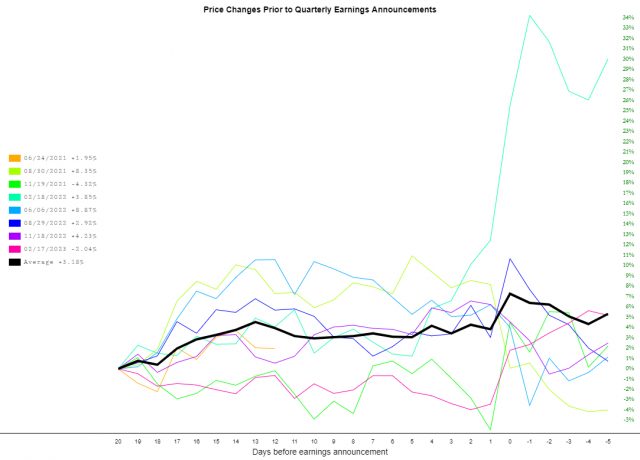

Here are some pre-earnings trades that looks favorable. Remember to click on any image for a screen-filling, easier-to-read version.

KR – Kroger.

16 Jun – 21 Jul is the calendar time frame. I like the 47 and 45 strike calendars (puts vs. calls up to you). Short the 16 Jun strikes, and go long the 21 Jul strikes. As an effective hedge, buy an equal number of 50 strike calls and 42 strike puts.

For 1 contract, this is around $193. There is a 3% or so move in the last 2 days on average.