Here are some pre-earnings trades that looks favorable. Remember to click on any image for a screen-filling, easier-to-read version.

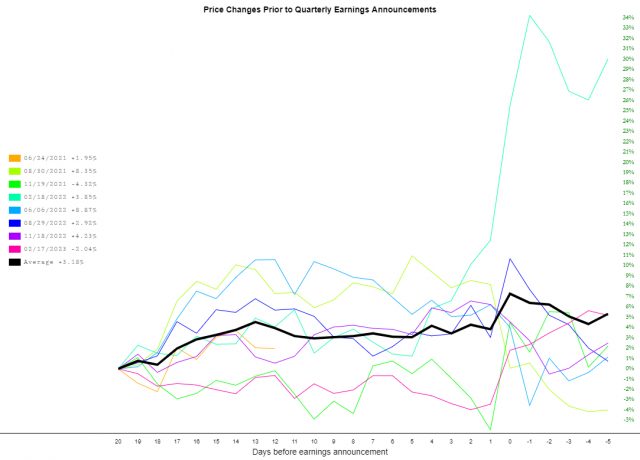

KR – Kroger.

16 Jun – 21 Jul is the calendar time frame. I like the 47 and 45 strike calendars (puts vs. calls up to you). Short the 16 Jun strikes, and go long the 21 Jul strikes. As an effective hedge, buy an equal number of 50 strike calls and 42 strike puts.

For 1 contract, this is around $193. There is a 3% or so move in the last 2 days on average.

With this strategy the outlying massive move (happened once in Feb 2022) will be highly profitable. It also not moving at all will be profitable. Likely an intermediate move will also be modestly profitable. Not a riskless trade but likely highly mitigated. Volatility almost certainly in your favor.

Make sure to get out by the end of trading on June 14th for highest gain.

For the last year this made about 5-15%. (2 losers, which would have been winners with this modified setup). Not bad for 2 days.

You can go through earnings as well but this is much more prone to becoming a small loss due to sharp decreases in volatility.

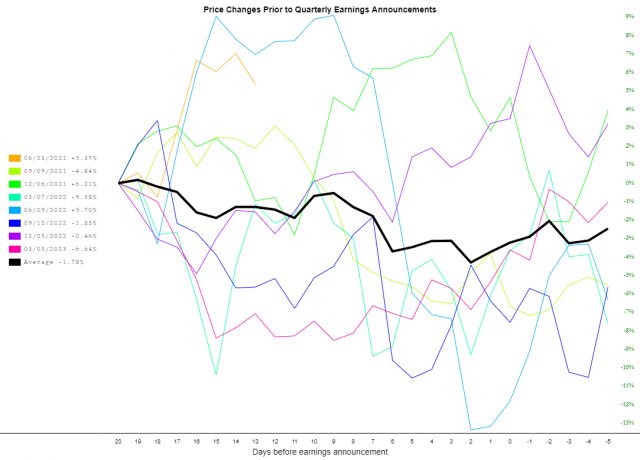

LEN – Lennar

Now let’s talk about LEN

A bit of a warning, these options are more thinly traded, so a word to the wise that it may be more difficult to get in and out. These are “C” options on SlopeCharts.

Choose the 16 Jun and 21 Jul time expirations. Overall for earnings there is about 1-2% movement.

Get a 110 and 115 calendar, put or call up to you

Add in 110 puts, and 120 calls, the same number as above.

3 contracts for all is about $2500. Gain is about 15-20%.

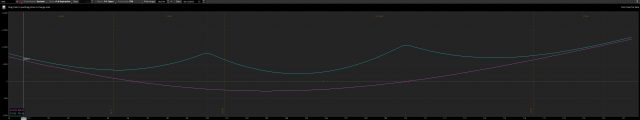

Overall the volatility situation is highly favorable (vol gain on both long part of calendar and long options, and on short options which lose more money than gain due to time decay, net-net the value of both calendar and long options go up over the next 2 days)

Get out 6/14 by end of close, ideally. If you do go through earnings it can still work, if the price doesn’t move at all or moves a lot. An intermediate move loses some.

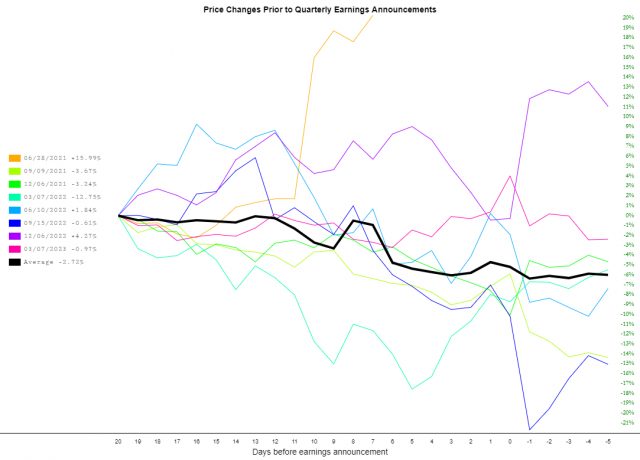

NKE – Nike

Now let’s look at Nike. They report on June 29th, so get out prior to close of this. Remember, you can close out earlier if you make 10-15% on the trade. Here we will use the 30 June and 21 Jul expirations.

Open the 100 and 110 calendars, again put or call your choice.

In terms of movement, we see about a 5% move in the next 13 days.

For the calendar: long ratio, put on a 5:3 ratio.

Let’s say 5 calendars were put on.

Put on three 100 strike-80 strike long put spread (Jul 21) and three 110 strike-130 strike long call spread (Jul 21)

Ideally get out by end of day June 29th.

Aiming for 10-20% gain on $2300 or so of cost.