Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

The Fad That Must Die

How often do you use ChatGPT? Never, right? You’re probably like me. Everyone on the planet was talking about it. You tried it out. Monkeyed around with it for a few days. Then you forgot about it and never touched it again. I swear to God, this whole AI thing is the most overhyped nonsense since the Segway scooter came out years ago, and tech luminaries (including Steve Jobs and Larry Ellison) declared that entire cities would be built around it. Just ridiculous………..

Fed Spread Extreme

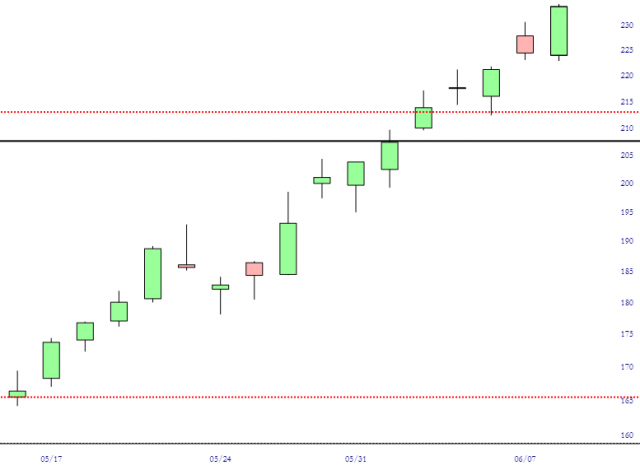

Thursday afternoon means one thing, and that’s the Fed Spread. I am probably going to resume putting these posts behind the pay wall next week, since this chart is about to get extremely interesting.

You’ll recall that, until a week ago, the Debt Ceiling was all anyone could think about. Now that it’s resolved (and the debt ceiling feels like it was about a decade ago), no one is thinking about it anymore, but I think there’s going to be a major impact on equities in the months ahead.

Walking through the three sub-components, we have the reverse repo doing nothing it hasn’t done for the past year. That is to say, it’s still floating above $2 trillion a night.

Fully Self-Driving

The Spread is Novel

This chart is remarkable. I confess, I’m going whole-hog on the new MetaSymbols feature. This chart is a real eye-opener. Using the Layered Charts feature, I put the QQQ on top of the $$$NASDAQSMALL (which is the QQQ except for the mega-caps). These two were virtually indistinguishable for years. That all changed on October 13th, 2022, which was eight horrendously long months ago. Since then, a virtual chasm has developed between these two, since virtually all the gains are being created by just a tiny handful of multi-trillion dollar firms.