Silk purse. Sow’s ear. You know the drill. Here we meet again.

Among the major markets, as I’ve mentioned previously, the only chart which I sort of like is the small cap futures. In recent days, I’ve found myself having to nudge the horizontal a little bit higher, and a little bit higher, and then a little bit more. But enough is enough. I consider myself an honest chartist, and there’s only so long one can play that little game. I’ve thus shoved the line back to a sensible place and accepted the fact that prices have, sadly, pushed above it. Maybe the pattern is kaput, or maybe it’s a temporary overshoot. We shall see. But I’m not doing to warp and distort the chart just to reach some desired conclusion.

Indeed, the only asset which seems to be steadily stumbling down the stairs is one in which I have absolutely no positions, and that is: gold. The hyper-rational thinkers, who concluded a while back that the only logical direction is for equities to fall and gold to rise, are surely losing their minds right now. Our world exited its brief dalliance with rationality last year and has returned to bat-shit crazy, its more comfortable state of mind.

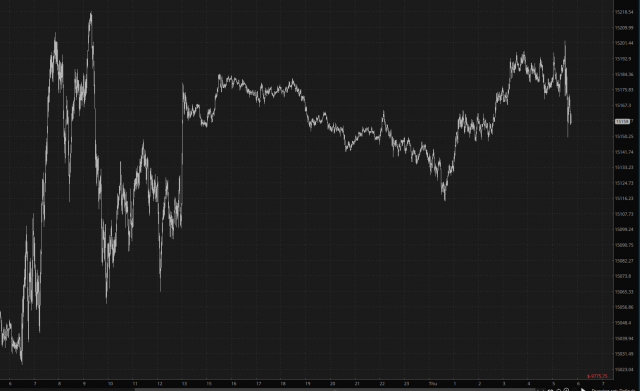

As we fumble our way to the end of this quarter (and H1 2023), the market continues to act just like goofy on a daily basis, such as the /NQ below. I’ve learned that the rips higher and lower pretty much mean nothing at all these days. As I said: rationality=bye-bye.

They would have carried me off on a stretcher months ago if I didn’t stick with the long-term bets, and that hasn’t changed. It’s all January 2024, folks, because I need to be able to shut my eyes to this short-good lunacy and keep focused on the long-term picture, which still might just work out beautifully, if given enough time.