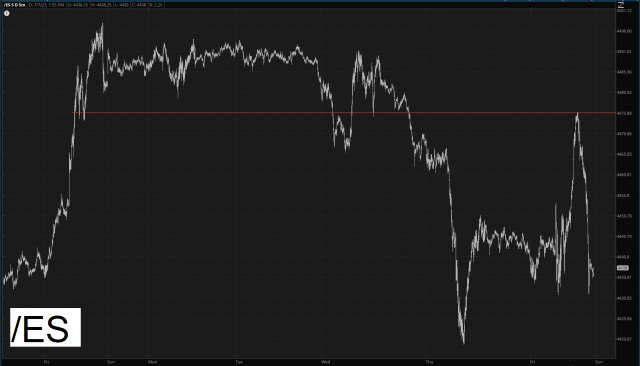

On the heels of Thursday’s fall in equities – – which felt like the first time the market sold off in decades – – it was interesting to watch the action on Friday following the jobs report. We got a pop higher, a sell-off, stabilization, and then a vomit-inducing explosion higher. Interestingly, once prices reached the mass of overhead supply, they fell throughout the balance of the session.

I managed to buy IWM September puts at almost the highest price of the day. Sadly, the small caps only lost a portion of the pop they had earlier in the day, whereas the /ES and /NQ both experienced total reversals. All the same, it was nice to actually manage to get a good price.

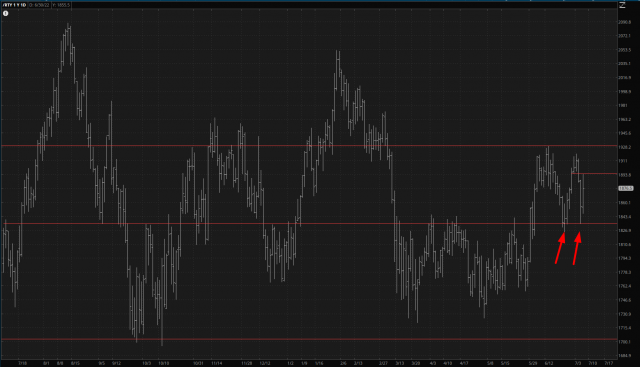

An hour or two of selling doesn’t amount to a hill of beans, however. What’s important is that the small caps crack their support level, highlighted below. Unless this happens, all this action is nothing more than the gyrations of a fiscal belly dancer.