Good morning, everyone. Well, this promises to be an interesting week. Tons of economic data and even more tons of earnings reports.

Of course, given 2023’s legacy, we approach the new week with all green equity futures. Just about the only red on anyone’s screen isn’t even related to equities, but crypto. From mid-June to mid-July, Bitcoin shot up 25% based on the latest Reason To Buy This Thing, which was that institutions were cobbling together funds so ordinary people could lose their money on it. Well, the thrill is gone, and BTC has eroded from around $31k to $29k in the past few days.

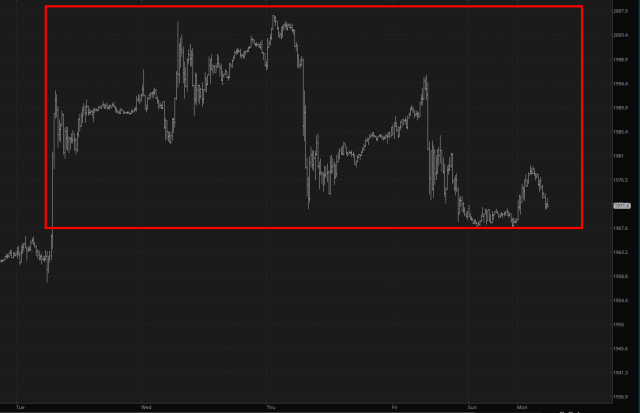

Getting back to equities, this is going to be a big week for tech stocks. On Tuesday afternoon alone, we’ve got Microsoft, Google, and Texas Instruments, with Meta and Lam on Wednesday and Intel on Thursday. Last week, tech slipped nicely, but earnings reports will be informing direction over the next few weeks. Here’s the NQ:

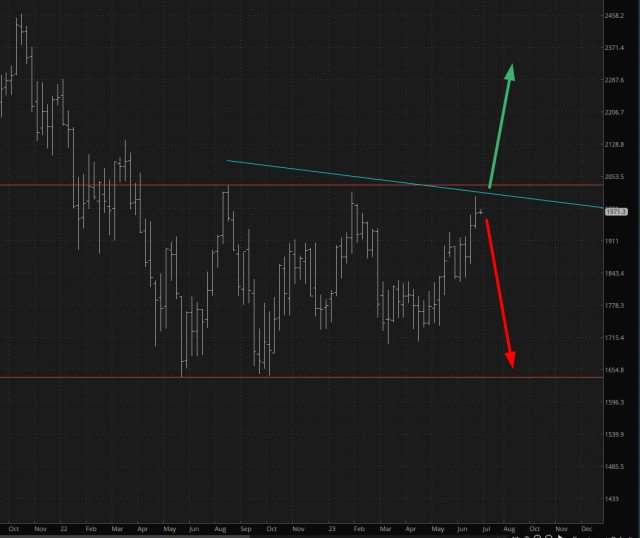

I continue to find the small caps (/RTY) intriguing, particularly since they are relatively close to breaking a level which would represent a trend change. As it is now, equities were modestly beaten down late last week, so they’re acting like they want to spring higher, at least to get back to their old ways.

Yet the longer-term is what really matters. As we step away from the /RTY to a bigger time scale, we can see two polar possibilities. One of them is a successful completion of the inverted H&S pattern, which would vault the entire market higher and basically make 2023 a bull-fest from one end to the other. The other prospect would be a continue erosion, which would feed upon itself, that would give us a chance to work lower in that well-established price range.

Of course, if any selling dares to take place, I happen to know an old witch in the forest with her magic mushrooms that can take all the pain away.