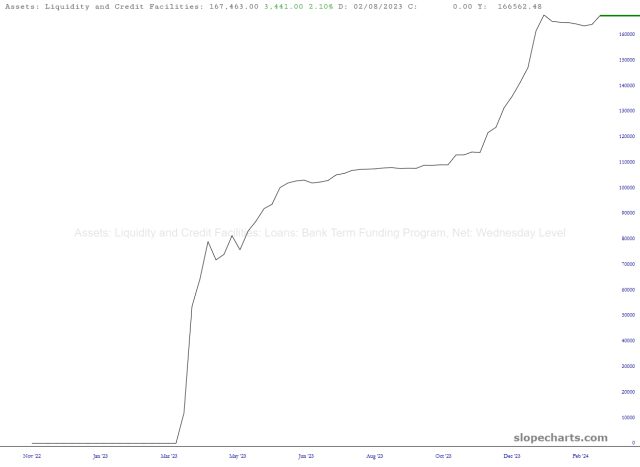

As we await the new trading week (completed with an FOMC on Wednesday), let’s look at the latest liquidity-related charts. We start with the just-closed-this-week BTFP program by that scum-sucker Janet Yellen. These “loans” are supposed to be paid back in a year’s time. Uh-huh. Anyway, at least it won’t grow anymore. That is, until the old biddy decides to start it up afresh.

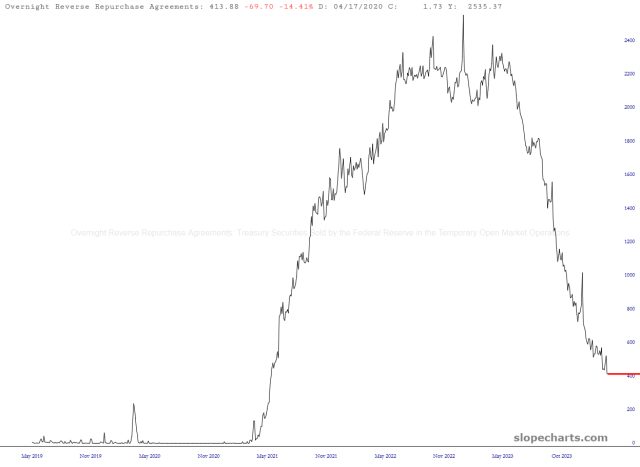

Reverse Repo is in a total free-fall and should be zeroed out within weeks at this rate.

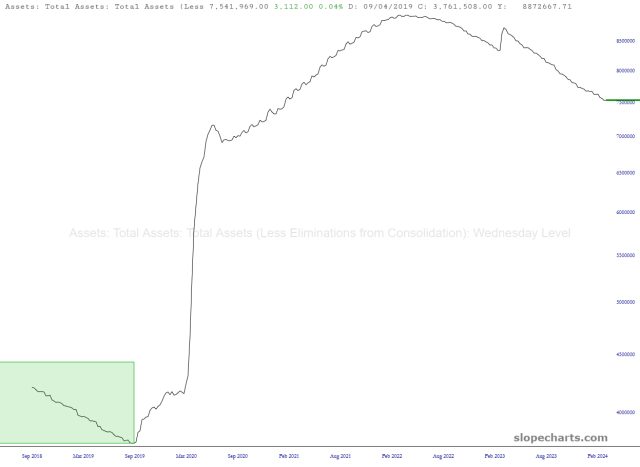

The Fed is slowly bleeding out its assets, although it is trillions of dollars from where it should be (that is to say, $0).

The calculated S&P is still about 600 points below where it “should” be.

The first three days of the week ahead and going to be awfully interesting, to see whether those failed wedges actually matter or not.