Welcome to a new trading week, one in which we get to enjoy one of the eight FOMC freak shows on Wednesday. As we approach the opening bell, everything is green across the board, with tech (the /NQ) being especially strong with a 1.25% gain pre-market. Since October 27th, the /ES has done little but stomp higher.

In spite of what appears to be a ceaseless bull-fest, look a bit closer and I believe you’ll recognize a subtle shift which took place last week. The wedge patterns on many important ETFs and indexes was broken for the first time and, yes, we’re up strong today, but my view is that we’re simply blasting up to resistance.

The small caps (/RTY) seems especially prone to weakness. They, too, are up as I am typing this, but only by only one-quarter of what the /NQ is, percentage-wise, and in the context of what appears to be a medium-term topping pattern.

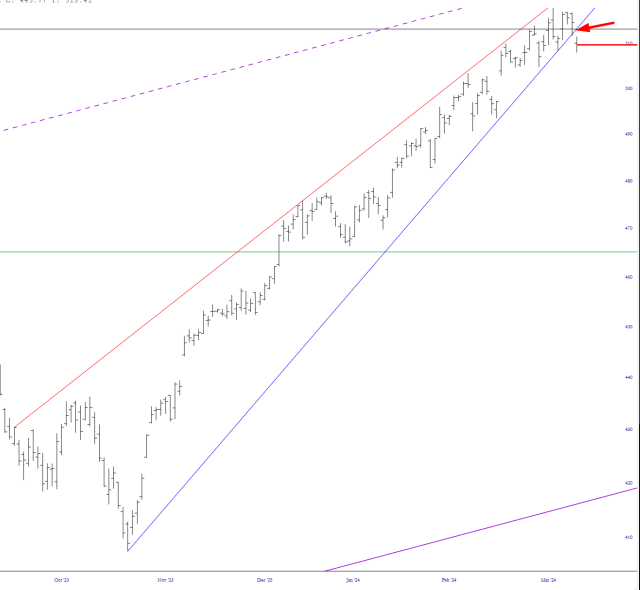

The point I want to make is to consider this morning to be little more than a bounce back toward resistance. Below is the SPY ETF, and I’ve placed a horizontal line representing where the SPY is trading right now. As you can see, at these levels, it’s a picture-perfect “last kiss before I say good-bye” vis a vis the wedge.