Preface to all posts: in an effort to get me out of a lifelong rut of avoiding humans and events at all costs, some friends are having me spend the weekend at a musical event. I’m driving very extensively and will be largely offline, so I’m putting up some Very Best of Slope posts in my absence. See you Monday morning!

Modern Monetary Theory

In the book Modern Money Theory by L. Randall Wray, the author declares of MMT (that is, Modern Monetary Theory) that it will go through three phases of public opinion.

First, it will be ridiculed. Second, it will be violently opposed. Third, and finally, it will be accepted as self-evident. I’m not sure if it will play out that way, but I’m here for offer an essay which is probably straddling the first and second phases.

Interestingly, this prediction was word for word what a certain Elizabeth Holmes declared in this video when she was making her final, desperate bid to save Theranos from its inevitable failure.

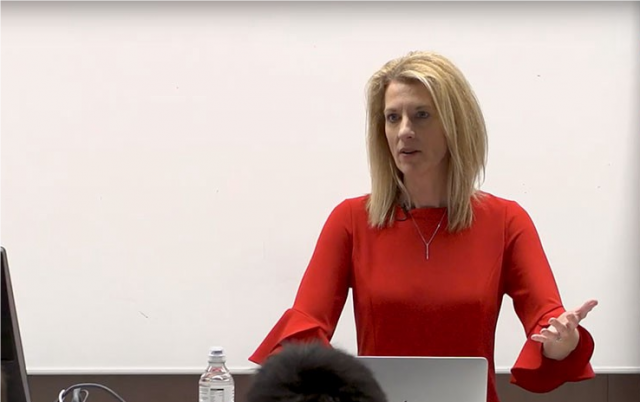

Anecdotally, I’d point out that Ms. Holmes bears a passing resemblance to the somewhat older but similarly crazy-eyed poster child of MMT, Professor Stephanie Kelton. More on her in a bit.

The Impetus

As with so many ideas in modern history, the seed for doing this post was planted in my head, unwittingly, by Dennis Gartman.

You see, back when Bitcoin was roaring toward its peak of $20,000, Mr. Gartman stated that although he didn’t believe in bitcoin as an investment, he did understand the excitement about the underlying technology.

That bugged me more than you might guess. I’ve been mixed up with technology since 1979, and I have lived my entire adult life in my beloved Palo Alto, California. I am deeply involved in the startup culture, and I have spent a fair amount of time studying cryptocurrencies.

And yet, with all that, I barely know what the hell I’m talking about. So, as presumptuous as it might be on my part, I daresay Dennis knows only a fraction of what I do about crypto, yet he had the temerity to declare his support of digital currencies (specifically, the “technology”) on national television, when in fact, I strongly suspect he didn’t have the first clue about it, except perhaps for mumbling a few words about how it has something to do with a “ledger.”

Thus, I didn’t want to be like Dennis when it came to MMT. And as much as people these days are talking about it, particularly on the political scene, I decided to spend an ungodly amount of time reading articles, watching videos, and reading cover-to-cover the not-terribly-exciting book I mentioned above.

In fact, it was a total slog. But I made it through, and now I feel that I’m at least qualified at cocktail parties to proffer a well-informed opinion without looking like a total choad.

I will mention, with respect to the book, that a drinking game came to mind during its reading. Specifically:

- each instance of “it takes two to tango” appears: one shot;

- each instance of the word “keystrokes“: one sip of beer;

- each instance of the word “wonky“: two shots;

- every time the author mentions how Keynes declared that the money of account has been chosen by the state for at least the past 4,000 years: two shots and toss some salt over your shoulder

For any of you intent on reading the book, please do not engage in this game, as I fear cirrhosis of the liver will be the inevitable result. Let’s just say the repetition started to get under my skin after a while.

Their Biases

I should make clear what I perceive as the biases, or shall we say assumptions, of the MMT crowd. In no particular order:

- A breathless adulation of John Maynard Keynes;

- A seething hatred of cryptocurrencies;

- Patronizing pity for the vast majority of people who don’t “get” MMT;

- Adoration of the government as the largest and most important part of our economy;

- Above all else, belief in the riskless nature of creating as many trillions and trillions of dollars as we need in order to create full employment.

Professor Wray writes over and over and over again about these points, with the overarching tone being that, God damn it, if people would just realize how money and the economy work today in the real world, we could solve all our important problems just by creating trillions and trillions of dollars and hurling them at infrastructure, jobs, and whatever else was needed to cure our woes. I get the sense his heart is in the right place, as is Ms. Kelton’s, but I’m far from convinced. In fact, I think the entire exercise is an intellectual experiment which sounds enticing in the classroom but, like Communism, would be a complete disaster with actual human beings.

My Biases

In fairness, i should probably lay out some of my own dispositions. To be clear, I have absolutely no ax to grind. It’s not important to me whether people despise MMT or love it. My entire mission was to learn about it for myself, and I’m writing this post with some off-the-cuff impressions just because I write for a living and might as well share my thoughts.

In any case, just so you know where I am coming from:

- I have always had an intuitive rejection of the idea that we should create trillions of dollars to optimize the welfare of our nation. Indeed, I would have vastly preferred, during the financial crisis, three to four years of agonizing financial mayhem, complete with massive bankruptcies, dislocations, and unemployment, instead of the nearly $60 trillion in bailouts that took place, because I think had we done so, we’d be in a vastly better place now. But we didn’t. So our friends at Goldman Sachs are still very much with us, ruling the roost.

- I’m a libertarian at heart, and thus bristle at government interference. In fact, the size of our government is loathsome to me, whereas the MMT crowd not only loves how big government is, but would have no problem with it being much, much larger (France is offered as an example, since 50% of their economy is evidently the government itself, which doubtless explains all the fabulous French innovations we keep seeing day after day.)

Let Them Make This Clear

The sense I got from the book as well as the pro-MMT articles I read was consistent: if we poor bastards in the general public who weren’t on the MMT train would just get a few basics through our thick skulls, we’d be part of their religion faster than you can say Benjamin Shalom Bernanke.

A few of these principles are:

- Sovereign governments are not like households when it comes to money (for instance, when it comes to balancing budgets) because they are currency issuers. Lord, do they hit on this again and again. So the quaint notions about revenue (taxes, tariffs, etc.), borrowing (bonds), expenses, and, God forbid, a balanced budget, are considered laughable and childish by the MMT crowd.

- The entire universe of money is contained in a closed system of three sectors which balance: (i) domestic government, (ii) domestic private, and (iii) foreign. Absolutely everything happens within this system, and one sector’s loss is another sector’s gain, every single time.

- Currency or money exists for one reason: because the state created a mechanism for citizens to pay their obligations to the state. “Taxes drive currency” was repeated more times than I can count, but the overarching point was that money exists to pay taxes, and the fact that everyone else uses it to buy stuff is incidental.

- The government can never run out of its own currency, and anyone who believes that a government has to sell bonds or raise taxes in order to generate revenue to spend is a deluded fool.

I also noticed a habit with the MMT crowd is to relabel and rename things (I think the euphemism they would use is “re-framing”). They speak of looking at things “from a new perspective”, and to nudge this in their direction, they refer to “The National Debt Clock” as “The National Savings Clock”, for example. It’s just like how Bill Clinton got people to say “invest” instead of “spend” when it came to government projects, but far more insidious.

The Munificent State

I have a theory about the excitement about MMT: the past ten years have trained people to rely on the government bailouts and goodies to an unprecedented degree. Just as the 9/11 attacks opened the door for the government to invade our privacy in ways unimaginable before, so too did the financial crisis give the government a free pass to go batshit-crazy with the debt.

And, as far as the public is concerned, since the nearly $23 trillion we’ve borrowed hasn’t seemed to have done any harm, they are all ears when people come along proposing that there are plenty more trillions where that came from, and we might as well indulge ourselves some more.

Professor Wray offers this:

“Government spending for the public purpose is beneficial, at least up to the point of full employment of the nation’s resources.”

So not only is the government the largest and most important part of the economy, it is also the most important employer. It’s the job of the Federal Government to hire every single person that wants the job, especially when the private sector doesn’t need them. All the government has to do is dream up something to keep these layabouts busy.

Take a moment and, in your mind’s eye: go to the DMV. Go to the Post Office. Go to the Internal Revenue Service. Think for a few moments about the people there. Consider their backgrounds, their lives, and how much they probably despise……….or at least barely tolerate……….their jobs. Imagine what a stampede there must be at precisely 5:00 when they are permitted to leave.

That’s the life of a government wage-slave. Millions and millions of them, grey-on-beige, the least motivated, least creative people of the land. That’s what the MMT crowd thinks is our most important employer. Mop up everyone who can’t find a job at McDonald’s, or the local gas station, or the Starbucks on the corner, and create cash and give them something to pass the day away. Every. Single. One.

Spending Good. Saving Bad.

When I was young, one of the most persistent political dreams in the air was a balanced budget. Indeed, the dream was to actually have a Constitutional Amendment to balance the budget. This was back when the entire debt was less than a trillion dollars, and even that amount, people considered shameful.

That ship sailed a long time ago, though, and I’m sure the MMT crowd is delighted. According to them, just about the worst thing in the universe is a balanced government budget, because in their “closed system” mindset of theirs, government deficits are fantastic because it simply means the private sector is enjoying surpluses. Professor Wray writes:

“The most unsound budgetary policy is the mindless pursuit of something called a balanced budget – meaning one in which tax “revenues” exactly match government spending over a stated period. If that outcome is achieved, it means that all the government’s currency supplied through its spending will have been returned in tax payments so that the non-government sector has nothing left.”

The pearl-clutching gets even worse:

“If the government runs a balanced budget, it will have made no net contribution to the financial wealth of the nation.”

To which my response is: why should it? I’ll manage my own household and small business, thank you very much. I don’t need the government to create debt in order to give me prosperity.

Wanted: Bureaucrats

It seems the paradise that MMT folks want is one in which gargantuan undertakings – – – free college for everyone, free healthcare for everyone, trillions of dollars of new infrastructure – – are all made possible by frantically banging the keys on the keyboard to create trillions of new dollars. Conjuring up such a vision, Wray writes:

“Imagine how the policy discourse will be changed when our President could no longer claim that Uncle Sam has run out of money. When our government can no longer refuse to create jobs, or to build better infrastructure, or to put astronauts on Mars because of lack of funds…There may be reasons we want to leave millions of workers unemployed, or to live with unsafe bridges and highways, or to remain earth-bound, but lack of funding cannot be one of them.”

If any of you think the government has somehow been ‘holding back” on handouts, giveaways, and “assistance”, I offer you this simple chart, which I find breathtaking. Admittedly, it doesn’t include a trip to Mars, but still:

MMT pundits refuse to believe that private enterprise can exist and provide on its own. Instead, its partner has to have a monstrously large big brother in the form of a government:

“The domestic private sector – by itself – cannot create net financial assets since every financial asset created and held within that sector is offset by a liability within that sector. In order for one sector to accumulate net financial wealth, at least one other sector must increase its indebtedness by the same amount.”

Ummm……….what? How about the trillion dollars in value created by the existence of Amazon? Or Microsoft? Or Apple? Within a 5-mile radius of where I am sitting, the value of companies that didn’t even exist twenty years ago represent trillions of dollars of new assets, all created by private enterprise.

None of that value was conjured up by a benevolent government “increasing its indebtedness”. It was because good ideas were turned into good companies that created jobs, products, services, and shareholder value. If I want someone to utterly fuck something up, I’ll be sure to get the federal government involved. Otherwise, I’d prefer they just leave me alone.

Kelter Skelter

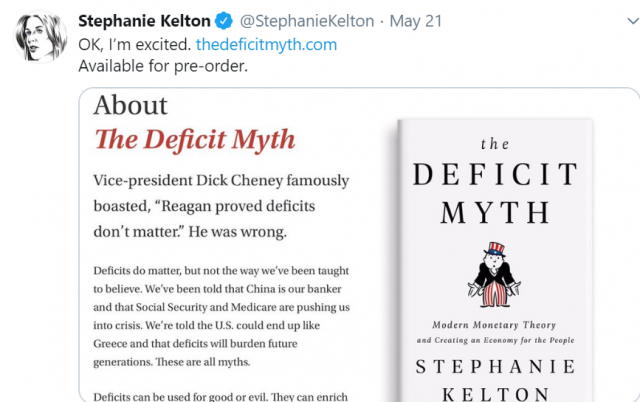

Earlier I mentioned the “poster child” for MMT, which is Stephanie Kelton, a professor at Stony Book and the former economic adviser to 2016 candidate Bernie Sanders. Professor Kelton has absolutely grabbed the media spotlight, and my belief is that people would probably prefer to watch her talk……….

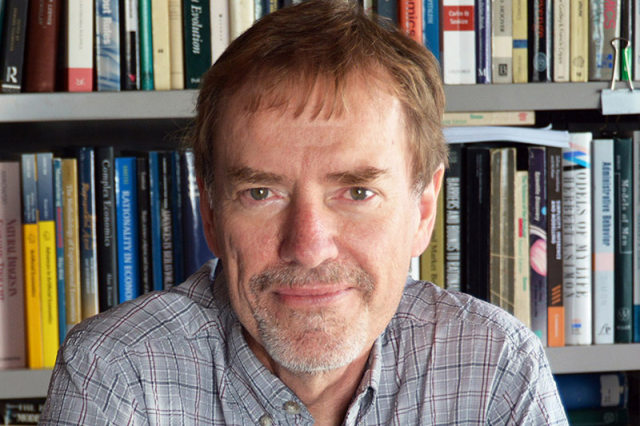

As opposed to, say, Professor Wray, who knows just as much as Kelton but, nice a guy as I’m sure as he is, isn’t getting the call-backs from TV producers that she has been getting:

In fact, I was wondering if I was being wrong-headed imagining the supposed reasoning behind her persistent appearances, but a brief glance at the comments section of any of her published videos will show that I’m not completely imagining this………..

In any case, Professor Kelton decries what she calls the “debt hysteria” and suggests people celebrate the trillions of debt we are creating. Her forthcoming book – – – which apparently is such a weighty project, it showed up on Amazon a full year before its release in June 2020- – is called “The Deficit Myth”. Just in time for the big election.

The bottom line for the MMT crowd is simple: in an economy, as long as the growth rate is higher than the interest rate, you can create as many trillions of dollars as you like without guilt, worry, or peril. The sky is the limit!

In fact, presidential candidate Andrew Yang has as his most memorable pledge that $12,000 will be given each year to every single person in the country, no questions asked. Free money! If that’s not buying votes, I don’t know what is.

“But what about inflation?!?” some may ask. “Those trillions are going to cause prices to skyrocket!“

“No, no, dear citizen“, MMT dude would say. “Look at all the trillions over the past decade in the form of TARP, QE1, QE2, Operation Twist. There’s no inflation! It’s harmless!“

That would shut most people up, but I actually have an answer for this: all those trillions went to asset inflation for the rich. Mansions. Stock values. Fine art.

Those trillions didn’t go to the guys going down to WalMart or stopping by McDonald’s for dinner. If they had, then prices at all those places would be much higher. So as the MMT crowd pounds on the desk, declaring that the relatively mild inflation we have today is proof that new money is harmless, I would say hardly any of that money found itself to the lower 95% whose purchasing power would have actually moved the needle. Andrew Yang’s proposal, however, would absolutely push prices higher.

The Fifth Dimension

One of my favorite protestations about MMT came from this article hailing from Business Insider:

Imagine if I told you that, of all the animals in the animal kingdom, elephants are unique because they live in five dimensions. All other animals get four dimensions (three physical dimensions plus time). But for some wacky reason, elephants get five. Then further suppose that, when you pressed me on why this is true, I assured you that my theory was sound and you just had to accept it. The analogy here is to the weird place of self-funding governments in MMT. All other entities – households, individuals, businesses – are subject to more “normal” economic rules. Yet somehow governments are the magical alchemist elephants… they supposedly have some bizarre fifth dimension factor (born of self-funding elixir) that makes them normality-exempt.

Absolutely! So the MMT people who scoff at regular old citizens like me, who still think that any entity, no matter how large, should still act with prudence when it comes to assets, borrowing, and expenditures. The MMTers seem to roll their eyes and declare that it’s foolish to think of the government as anything akin to one’s household. The rules just don’t apply.

News to Me

It seems the longer one lives inside the MMT rabbit hole, the more sane otherwise crazy statements must seem. I offer this from the same book:

“The Fed is not a private institution, but rather a creature of Congress and no more independent of government than the Treasury, the Department of Defense, the Department of Transportation, or the Internal Revenue Service…………the Fed serves at the pleasure of Congress.”

Yeah, at the pleasure of Congress. That’s why we get to read an annual audit of the Fed, right?

There’s more………..

“In the United States during the Clinton boom there was a projection that all outstanding US Treasury debt would be retired….if we ever did get to that point….you’d have to turn over your car, house, bank account, and children to the government to pay taxes! That is the logical result of a government surplus carried to infinity.”

/Bill-Clinton-Debt-56a9a77a5f9b58b7d0fdb413.jpg)

Financial Circle-Jerk

As gluttonous, intrusive, and nettlesome the government already is, MMT says it isn’t doing enough, and that the government should really be a lot more ambitious about how much money it creates and spends, since whatever self-control it is already exercising is misguided:

“The sovereign government always gets ‘free lunches’ by keystrokes. The US government potentially gets bigger lunches. However, the truth is that almost all governments – including the US government – have put themselves on near-starvation diets as they refuse the free lunches that are on offer!“

Thus, whereas in the Reagan years the mantra was to “starve the beast”, the MMT crowd wants to feed it. Because God knows free enterprise needs the help. Wray allows that private enterprise shouldn’t be absolutely extinguished altogether:

“We also need to analyze effects on the private sector. The more resources we remove from private use to allocate to public use, the greater the likelihood that we could have a bloated government sector and a private sector that is too small. We need to leave an adequate supply of resources for the private sector to achieve the private purpose.”

And yet, the monstrosity in Washington D.C. really should get larger, since it’s evidently both wise and munificent:

“According to Minsky, government was far too small in the 1930s to stabilize the economy (in 1929 the federal government was about 3% of GDP)……..based on current realities, it looks like the national government should range from the US low of about 20% of GDP to a high of 50% in France.”

Human Nature

As with Communism, there seems to be with MMT an underlying assumption of innate human goodness, cooperation, and morality. I’m not that cynical about human nature, but to my mind, replacing the dog-eat-dog reality of vying for good jobs with a universal assurance of make-work jobs working for the government doesn’t exactly make my heart sing.

Yet Professor Wray seems to think that the pledge of Job Guarantee (JG) and government serving as the Employer of Last Resort (ELR) would be transformative for all society. He states::

“Benefits include poverty reduction, amelioration of many social ills associated with chronic unemployment (health problems, spousal abuse and family break-up, drug abuse, crime) and enhanced skills due to training on the job.”

Uh-huh.

Along with this theme, none other than Keynes is brought back from the grave:

“As soon as we have a new atmosphere of doing things, instead of one of smothering negation, everyone’s brains will get busy, and there will be masses of claimants for attention, the precise character of which it would be impossible to specify beforehand.”

I’m not sure if you’ve taken a good look at the people that are still unemployed in this jobs-are-begging economy, but the MMT fans are plausibly positing people, once gainfully employed, will attend plays, listen to music, and volunteer, instead of, say, sitting on their giant asses watching the tee-vee.

Hey, Wray, what else can you say?

“Shorter work days and more paid vacations is a progressive goal to humanize the work place. More time to enjoy one’s family, recreation, and the arts. More time for self-improvement and community involvement.”

Yeah. Self-improvement. As I walk down University Avenue and see the crazed homeless wandering around, I know the only thing standing between them and a community center course on self-actualization is a government job.

Utopia, Inc.

You can probably gather I’m not exactly a fan of the concept. For me, one of the largest flaws in the thinking is the doe-eyed optimism. Keep in mind, although Wray isn’t as comely as Ms. Kelton (and thus doesn’t get the media exposure), he is one of MMT’s respected authorities, and he states clearly:

“Government spends currency in the public interest. It promises to accept its currency in payment. The tax system stands behind our currency, and we pay taxes to keep the currency strong. Good budgeting with transparency and accountability of elected officials ensures government doesn’t spend too much.”

Ah, yes. Good budgeting with transparency and accountability. That’s just what we’ve all come to expect from our elected officials. Jesus Christ.

And, in a touching coda, here are the closing words of the tome:

“We deserve this access not because we pay taxes, but because we’re all in this together. We take care of our own. Government helps us take care of our own through its social spending – for retirement, for medical care, for food stamps, and for support of poor families. We take care of our own. Together we can use money to take care of each other. Together we can make this a better world.“

I wonder if someone could print up some fresh dollar bills so I can run out and buy a bucket. I think I’ll be needing it very soon.

Honestly, people. I’m a simple soul. And I believe all that dumb stuff our parents told us – – there’s no such thing as a free lunch………you can’t print your way to prosperity………..…it’s actually all true. The silly homespun wisdom that made us all roll our eyes as kids is actually worth heeding.

The risk – – and, having learned about MMT, I use the word risk deliberately – – of these ideas propagating into massive reality is, I believe, very small. Hell, the United States couldn’t muster enough wherewithal to change to the metric system, so I seriously don’t think it’s about to turn its economy on its head with this lunacy.

Still, with a big election coming up in 2020, and with endless trillion dollar deficits as far as the eye can see, we need to be on the lookout for these kind of ideas so they don’t become a virus of the collective mind. It took me a very, very long time to get even a passing knowledge of these concepts, and I suspect, oh, somewhere close to 98% of the public just wouldn’t bother.

But I suggest you bother. It’s worth it to know what that $12,000 check in your mailbox is all about.