Preface to all posts: in an effort to get me out of a lifelong rut of avoiding humans and events at all costs, some friends are having me spend the weekend at a musical event. I’m driving very extensively and will be largely offline, so I’m putting up some Very Best of Slope posts in my absence. See you Monday morning!

Oh, Hi Mark to Market

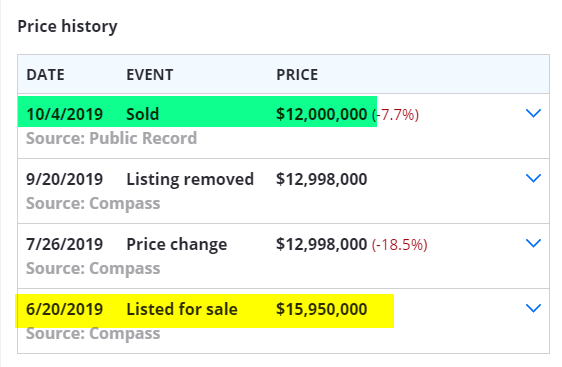

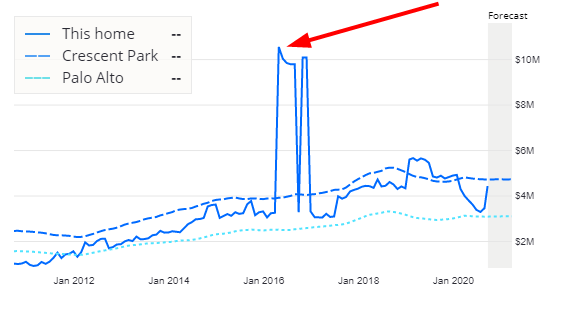

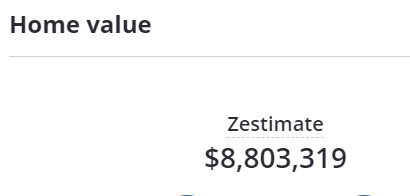

I penned a recent post describing how the good people at Zillow had slashed the ostensible value of my lovely private residence from $8.4 million to $4.8 million (maybe they just like flipping digits?) Given the relatively smooth sailing of Zillow data, this was curious to me, until I stumbled upon an event that might have jostled their statistics: the sale of the home of my next door neighbor:

Now, I realize you don’t come to Slope to keep tabs on the value of my assets, or the transaction data for my neighbors. Yet I think this instance is a microcosm of what’s going to be going on with assets as a whole across the country, be it commercial real estate, common stocks, or high-end art. You name it, and I think it’s going down (the U.S. deficits and debts notwithstanding).

My next door neighbor was the managing partner at Summit Partners, and God knows how much money the guy had. Nine figures, probably. Did you see the movie Jurassic Park? He owns the land that they filmed it on. He’s that level of rich.

So the hit he took on his home probably didn’t bug him, but it’s pretty clear the ask-any-price-you-want days in Palo Alto are long gone:

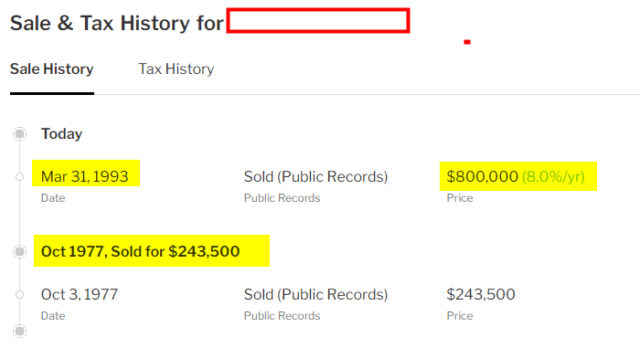

He got $4 million less than he wanted. In other words, he had to have a 25% Off Sale on his own property, which as the photo above indicates, is a really lovely place. Of course, prices weren’t always this zany, as tax records from the past prove:

But, peaking a few years ago, prices were absolutely bonkers around here. If you look back at this post for a little under a year ago, I wrote about a number of high-end properties, including one just a few doors down from the aforementioned neighbor which sold for $10 million. What the (Chinese, all-cash) buyer got for that $10 million was a tear-down bungalow.

I hadn’t even looked at that property’s value in a while, but I just glanced, and it’s about $4.6 million (which I doubt they could get). So this rich Chinese dude, who wanted to put his money in America for safekeeping, has torched over half his investment. Nice going.

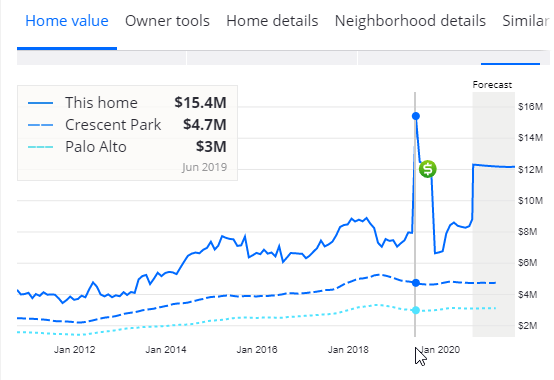

Anyway, back to my next-door neighbor. Below is a chart of his property. As you can see, the price spiked to a peak of $15.4 million (which, oddly, was below the $16 million asking price they used when they put it on the market) and then utterly unwound. The projected price is, I suspect, wishful thinking.

Indeed, even though the buyer used his clip-n-save 25% off coupon to get the house for “only” $12 million, he might be sorely disappointed if he glanced at Zillow’s present valuation. Assuming he paid 20% down, he would have to eat his entire down payment to walk away at this point.

The point of the story is that Palo Alto real estate is just a drop in the ocean of overvalued assets. It’s going to take years for people to wake up to what honest valuations actually are. Let’s just say I’m happy I moved into my present house almost twenty years ago, and not in 2016.