It is truly remarkable how little land in the western U.S. is privately owned, even these days.

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

It is truly remarkable how little land in the western U.S. is privately owned, even these days.

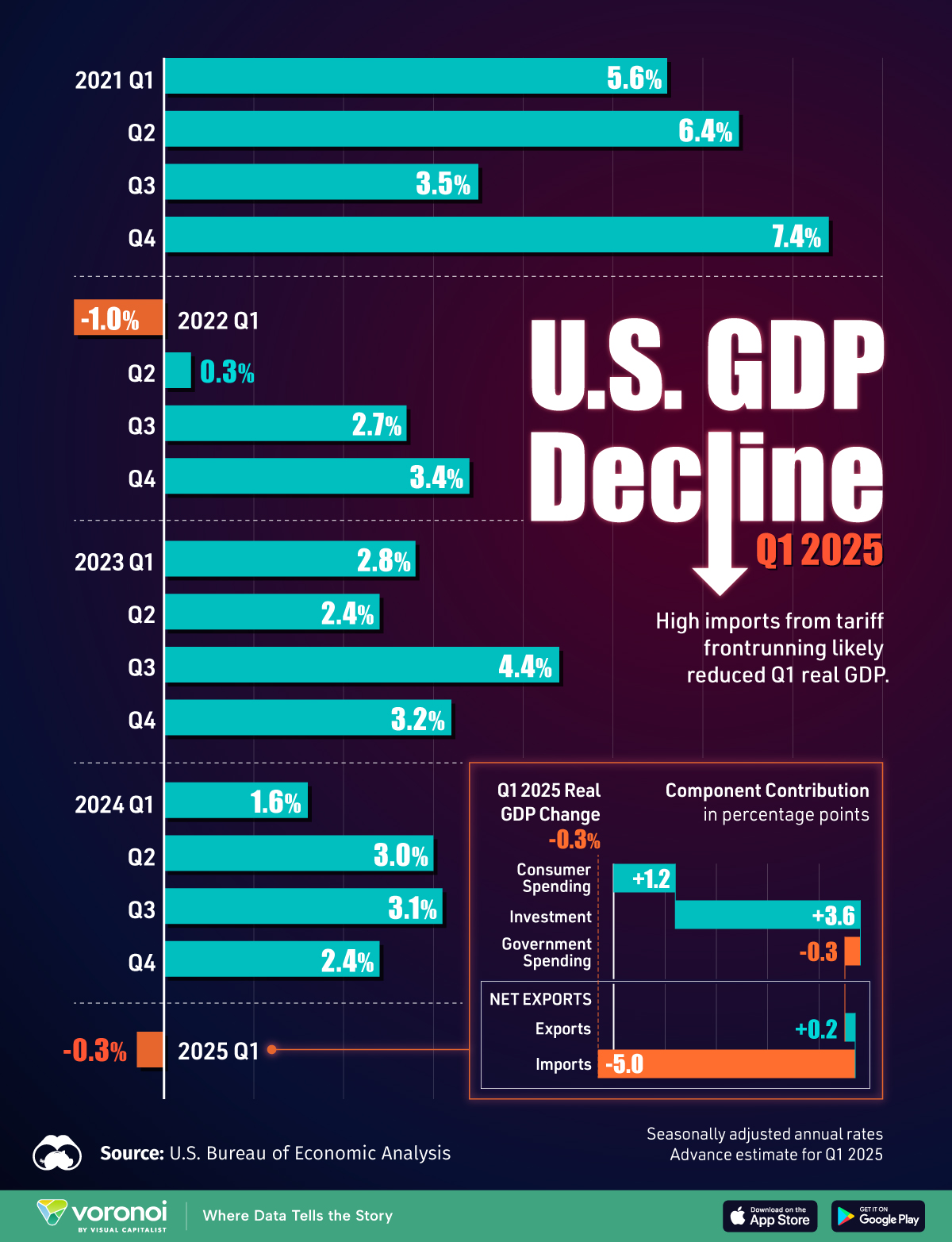

Q1 2025 registered a modest dip in the U.S. economy, which also happened three years ago without any real consequence. If perchance Q2 2025 comes in negative, that’ll qualify as a recession. Perhaps the very brief trade war will provoke a negative number? We’ll find out this summer.

If you want a sense of the market’s opinion on how good the UK trade deal is for Britain itself, just take a look at the ETF devoted to United Kingdom stocks and see how it did today.

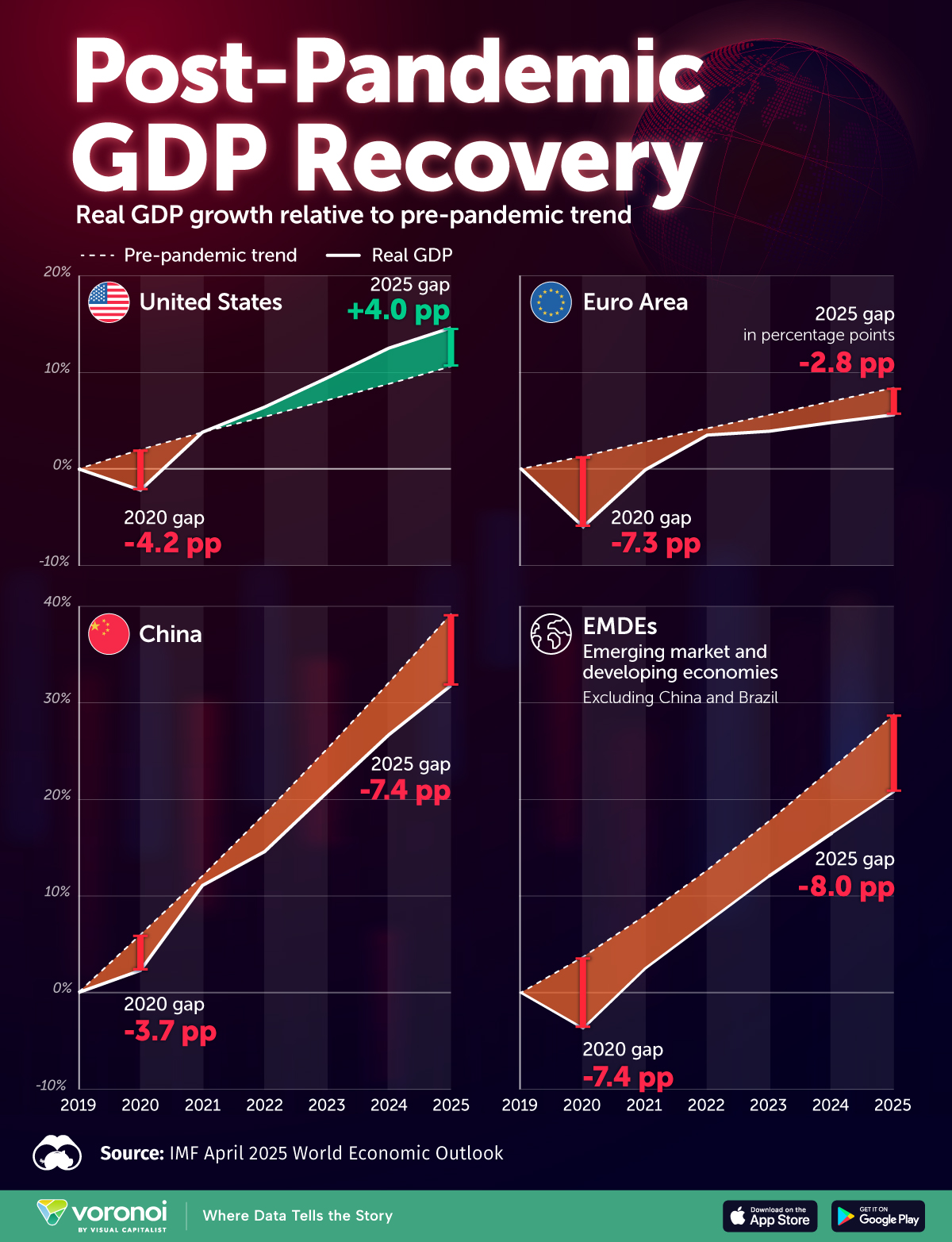

It’s impressive how well the United States has recovered from the Covid-19 nightmare. The rest of the world is far behind.

In the midst of the – – excuse my frank and honest language – – complete horseshit that went on during this trading day due to the not-even-a-little-important UK trade deal, I managed to strap on a pair and actually short some equities. I’d like to high two of them: EFA and XLB.

Truth to told, although there were some truly new positions (like PLTR) these two ETFs already existed in smaller size in my portfolio as of yesterday, but they behaved well enough that I wanted to add to them. The first one, EFA, pulled off the virtually miraculous feat of going down on the day. Indeed, I did a premium post about EFA just yesterday.