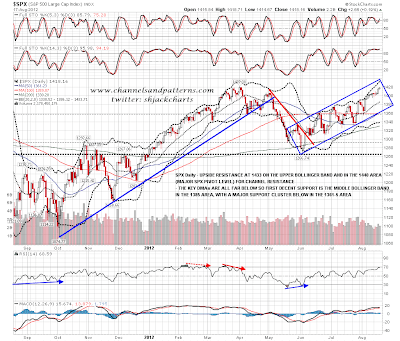

SPX continued the slow low volume grind up into the end of the week. ES has so far ground up a little further overnight. SPX came within 4 points of testing the April high on Friday and I think there's a very good chance that that will be exceeded and the 1440 area SPX pivot will be tested. I was talking about the technical significance of that test in my weekend post at MarketShadows which you can see here. In the meantime I have short term trendline support in the 1405 and 1398 areas, and on a break below those the daily middle bollinger band is now at 1386:

EURUSD is consolidating in a rectangle and is building energy to go somewhere. If the support trendline from the low breaks I'd expect that move to be downwards. As I said the other day, the pinocchio through that trendline was a bearish signal:

Not much to add to that on equities. Nothing much interesting happening on oil either so I'll have a look at silver and the ongoing Dow Theory divergence between Dow and Tran. On silver major support was hit in late June and has held so far. The bounce looks anaemic and corrective so far and the obvious bounce target is the 200 DMA and declining resistance in the 30 to 30.5 area, if silver can summon up enough energy to get there:

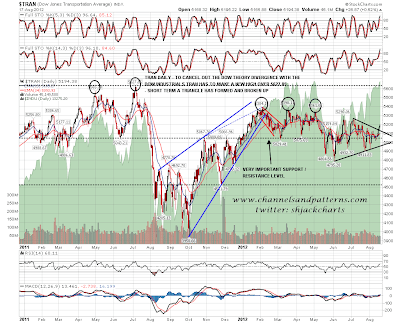

Looking at my Dow vs TRAN 2 year chart you can see the very large divergence between the two indices at the moment.Dow needs to reach the red dotted line just above to beat the 2012 high. TRAN however needs an impressive move from Friday's close at 5195.22 to exceed the 2011 high at 5627.85 to cancel out the current divergence and confirm the new highs on Dow. That could happen, but the current divergence is large and looks bearish as long as TRAN doesn't approach that 2011 high:

Shorter term on TRAN a triangle has just broken up that should take TRAN at least to the top of the triangle in the 5270 area, so I'm expecting at least some more upside there:

The 60min RSI on SPX is hitting overbought again so we could see some retracement here. No divergence worth the mention though unless you look at ES where it is a little more impressive. I would like to see a move to either 1405 or 1398 on SPX to strengthen the respective rising support trendlines there.