Here’s how things stand as at 10:30 am EST.

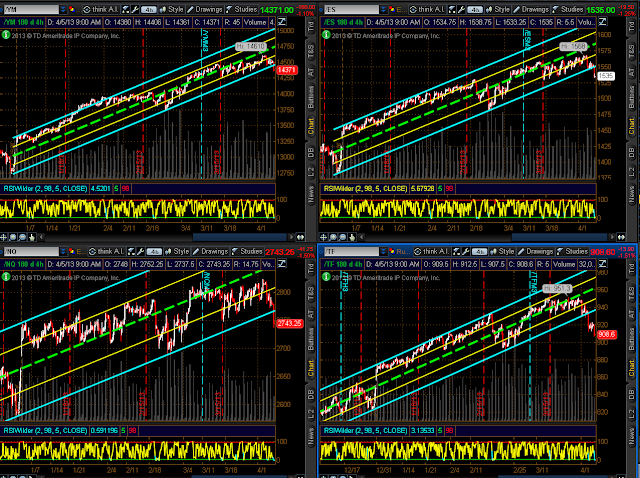

The YM, ES, NQ & TF are contending with an opening gap down. The NQ & TF are leading in the weakness as they are back in their old (lower) trading ranges.

The YM, ES, NQ & TF are all below their 2013 rising channel now. Their 4-hour uptrend has been broken.

The NDX & RUT are in the process of forming a very bearish “Tower Top” pattern on their Weekly timeframe. The NDX is doing so at an ominous-looking triple top. Once these are confirmed by a lower weekly closing low, I’d expect further weakness ahead.

With the exception of a slight improvement in U.S. Trade Balance and the Unemployment Rate, the rest of the jobs data, along with earnings data eroded (some of it quite substantially) from the prior month’s release (including Canada’s job and trade balance data). (The following data is provided courtesy of : Forexfactory.com and Nasdaq.com).

World markets are down today.

And, finally, European banks are, mostly, taking a hit.

All in all, this is not a good ending for the week. Central Banks can only do so much. Unless strengthening economic data begins to surface, with supporting investor confidence, the markets will only inflate artificially without full investor participation…otherwise, we’ll see underlying weakness continue in the equity markets.