Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

An Old Miners Prediction

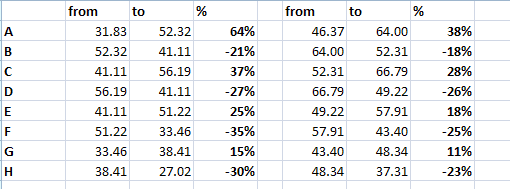

I was looking for a spreadsheet document just now when I saw a file on my hard drive called “GDX Prediction”. I was intrigued and I opened it up. It looked like this:

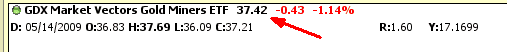

I couldn’t really tell what I was trying to get at, except that it was obviously some kind of analog, but I noticed that the final price level I predicted from nearly a year ago was $37.31; I glanced at the quote for GDX…….

Hmmm. I took a look at the date stamp on the spreadsheet (it was from May 11 of last year), and I dug through the calender archive of Slope, and I managed to find the post, which is right here.

So, errr, I guess this prediction worked out great, although I sure wish I had some more context! I’m as bearish on miners as ever, as most of you know.

Why Financials and Google Are Lagging

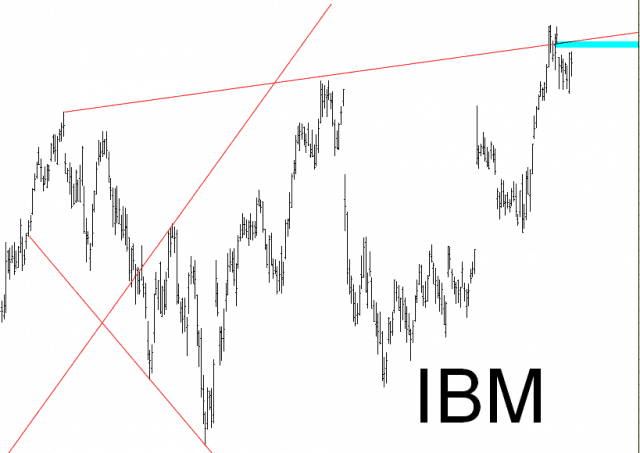

Shorting the IBM Gap

There is a gap in the price of IBM between March 20 and 21 which has been pretty much closed, and I’m shorting into that with at stop at 214.31

A Good Start to a New Quarter

Good morning, everyone,

First, some folks have been scratching their heads, wondering why every single article on the new Slope appears to be by me. This isn’t an ego-maniacal plot on my part to claim credit for the hard work of others; I won’t get into the technical details, but rest assured, from now on, the “by-line” of each article will reflect who wrote it (and, ahem, hey you writers, I could really use some extra content right about now!)

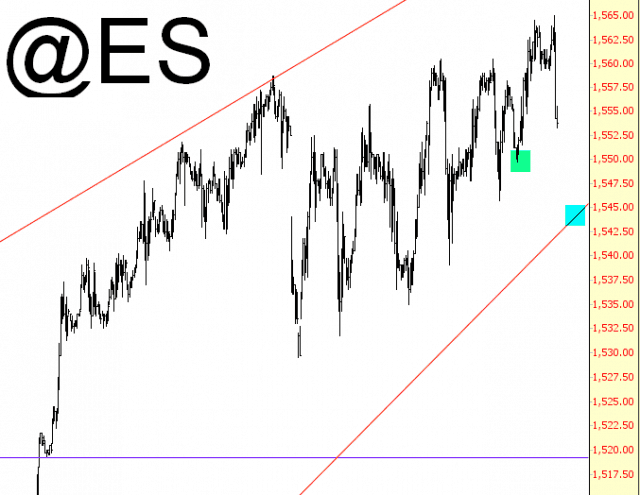

Second, I’m pleased to see the equities take a slip this morning, although we are still well within the confines of an ascending bull channel, and thus it’s nothing to high-five about yet. For myself, I came into the day short 82 different positions, and I’m adding a bit here and there. I was pretty heavily committed going into the day, so it’s a good morning so far. We need to break the green tint below to bust the series of recent higher lows, and more important, we need to bust the cyan tint below to snap that nettlesome ascending channel.

I had a bit of a tragedy with one of my hens yesterday (on Easter, of all days), so I’m afraid I will be attending to some family business (particularly with respect to children with a deep love of living things), so forgive me if I’m less “around” today.