Id like to share a brief post to outline some concepts that I track on a daily basis. I have found these concepts at work in all other issues I have tracked. This particular one pertains to AAPL, the downtrend of late and some features that may be foretelling of a bottom in the stock. Keep in mind this is a continual work in progress. I hope you will find it of some interest, if only to see the inner workings of moving averages in action. I wrote the following on 4-1.

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Confirmation or Head Fake XLU : SPY

One day does not make a correction, but certainly a couple of weeks indicates that there is a slowing of the amazing tone deafness of the SPX to the movements in bonds and the emerging markets. Here is our old friend, XLU:$SPY which highlighted that investors were over allocating dollars to the defensive utility sector relative to the SPY.

Even though the SPY continued to move to “all-time highs” XLU began to beat the performance of the market in the last several months. I am now looking for a quick snap fall here over the next week, a display of resilience that powers us up to highs, and then a brutal fall through the summer.

As you look at the chart that I posted many weeks ago, the XLU:SPY was signaling a turn way ahead of this weakness. We’ve been looking for a confirmation. The transports were battered, and perhaps have a bit more to go before reversing higher in the short term

Goatmug is an investor that cares about you and your family. Goatmug’s Blog – Financial Perspectives From The Mountain Top is a collection of thoughts on our economy and how it impacts the lives of investors and average people. While several specific investments are named in many of his posts, these articles are simply invitations for you to do your own research and reference to these securities does not constitute financial advice. Your situation is complex and unique and you should seek professional assistance with your trading and investing. Please visit Goatmug and share your comments at http://www.goatmug.blogspot.com/

Small-Caps Lead in Today’s Weakness

(Note from Tim: my “free month” of Slope+ is a big hit, but I wanted to move on to a real post; be sure to check out my special offer if you haven’t already; anyway, let me turn the microphone over to Strawberry Blonde…….”)

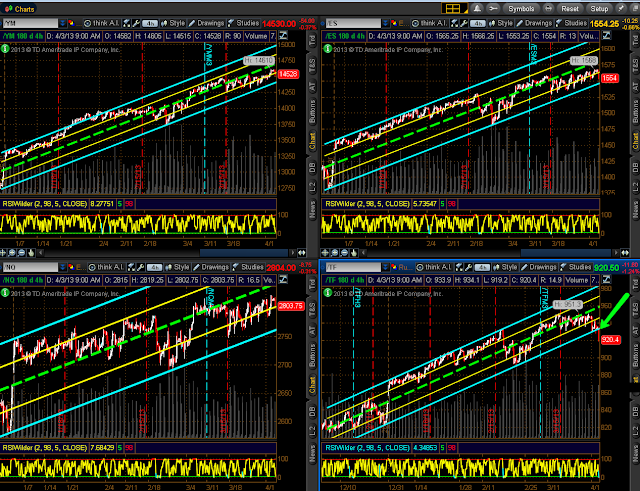

As of today (Wednesday) at 12:30 pm EST, the TF has broken through and is now trading below this year’s strong uptrending channel, as shown on the 4-Hour chartgrid below of the YM, ES, NQ & TF.

We now see a series of lower lows and highs on the TF, but not yet on the others. Any retest of and failure at the bottom of the channel by the TF will likely produce a drag (and possible pullback/correction) on the other three.

UPDATE 2:00 pm EST — The last swing low of 1552.50 (and uptrend) has now been broken on the ES 4 Hr. as it is approaching the bottom of its channel at 1546ish.

Celebrate with Slope+

What a day!

I’ll put up a real post later, but I thought I’d celebrate a bit by offering anyone who wants to try Slope+ a free month on the site. You can learn about Slope+ here:

If you have no account on Slope of Hope at all (such as one you use for the comments system), and you are basically signing up from scratch, click here.

If you do have an account, and you’re already logged in, click here.

I’ve made a coupon that’s good for the next 24 hours, so enter 624F60A1 where it calls for the coupon code, and voila, the next month is free. Just because.

And now, to make a good day even better, here’s a completely gratuitous picture of Sherilyn Fenn.

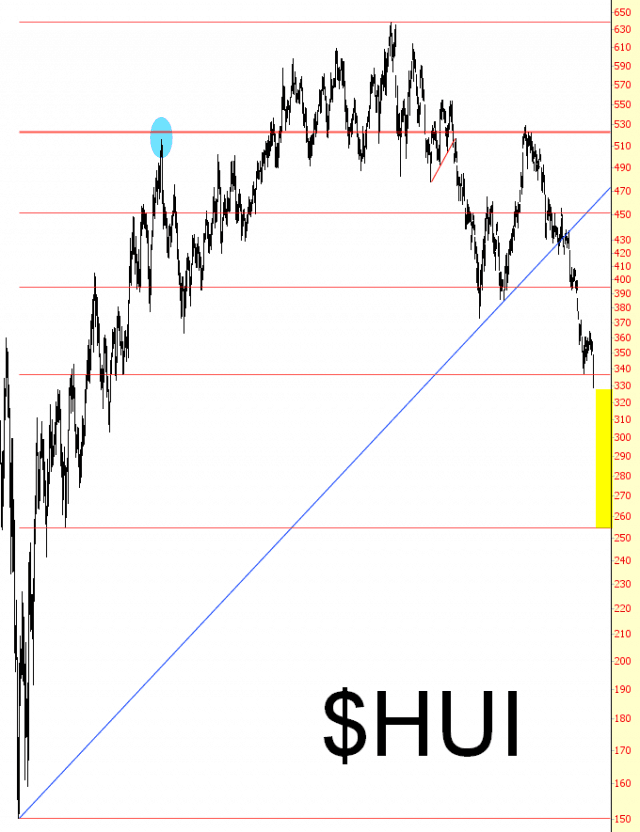

The Miners are in New Freefall Territory