As fractures and fissures appear in the life cycle of USD fiat, Gold looks to be beginning its third bull market in 50 years.

To profit from the rise in Gold, perhaps the best way to invest is through mid-tier and junior mining companies.

An investment in popular GDX may seem the obvious [and easiest] choice, but for superior gains it may not be the best. Others who have done the 10-Q and 10-K research to vet the numbers, conclude that the largest gold miners face serious challenges of growing production, which is fundamentally linked to company growth and thus stock price.

Here are a few miners [and streamers] that may have a better chance for upside price potential than GDX.

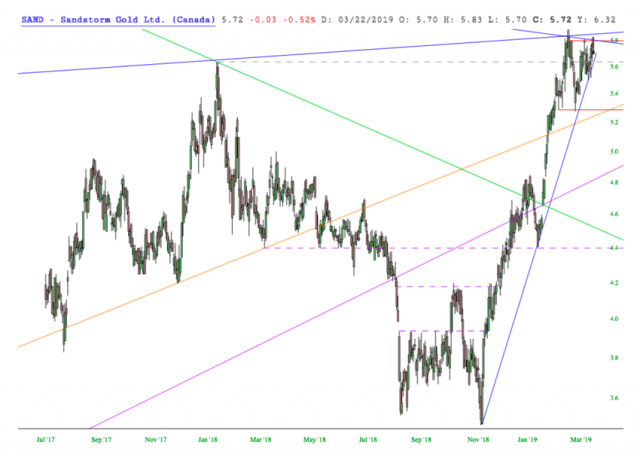

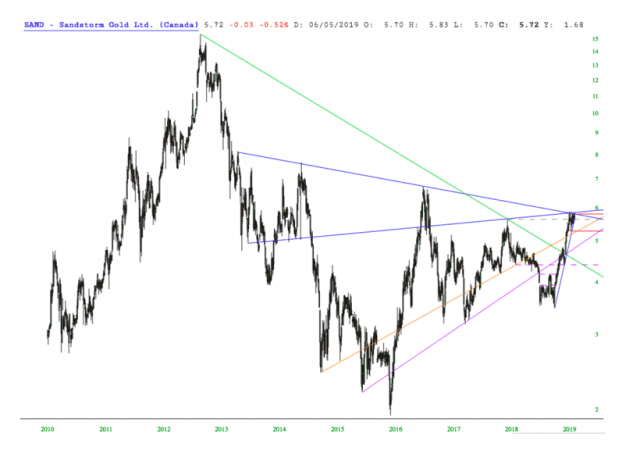

Sandstorm Gold [streamer]: We should have bought at the purple lines; now it contends with resistance, so let’s see what happens between the red lines.

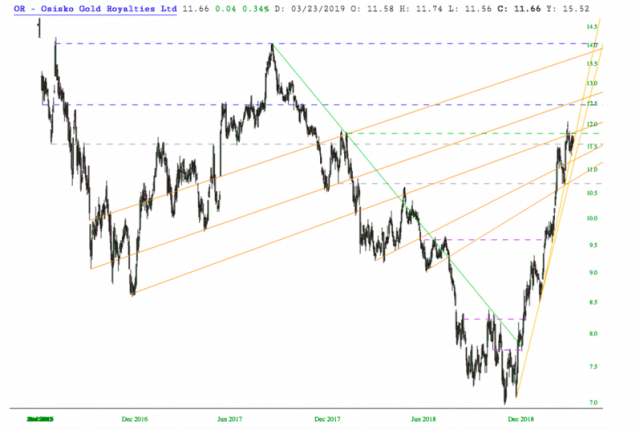

Osisko Gold Royalties: What a rise [and where was I…?]; now looking at 11.80ish resistance.

Alamos Gold: Looks to have put in a double top.

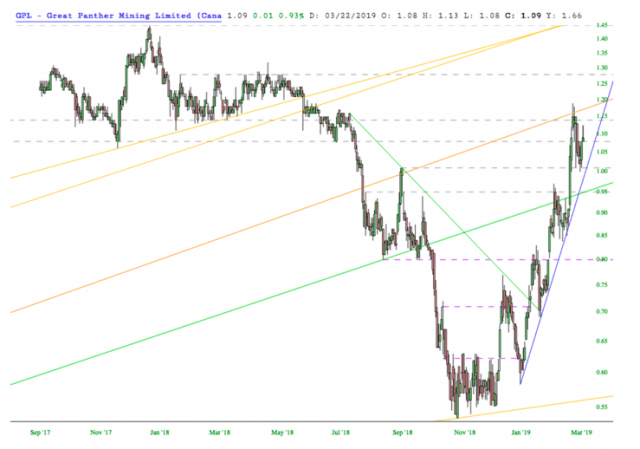

Great Panther Mining Limited:

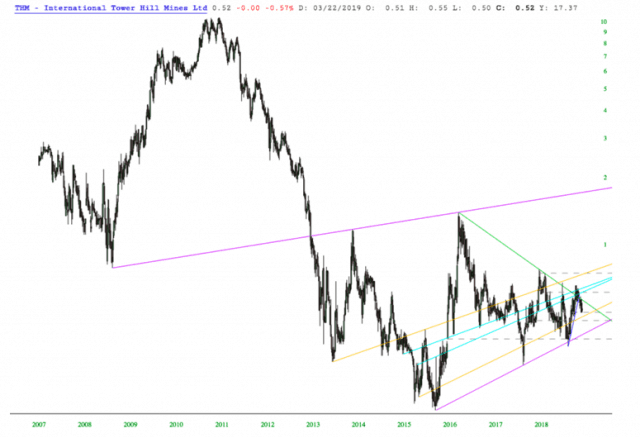

And a penny Miner for the fun of it. I think 0.62 is a given and 0.75 a reasonable target.

International Tower Hill Mines:

I have placed these issues in a shared Watchlist on SlopeCharts, “SharedMiners”, accessible to Gold and Diamond.