Happy Monday, everyone. I had an enjoyable and productive weekend. I hope most of you saw the news that SlopeRules now has optimization for almost all its indicators (which took gazillions of calculations, but Slopers are worth it). The Slope Development Train is chugging along, and you can expect a continuous series of new improvements and features.

For my own portfolio, I was pleased to see that the Mueller report, ironically, did nothing to bolster bullish bets. However, I’ve eased back this morning from nearly 200% invested to 128%. The risk of some kind of counter-trend bounce is too high for me to just sit around.

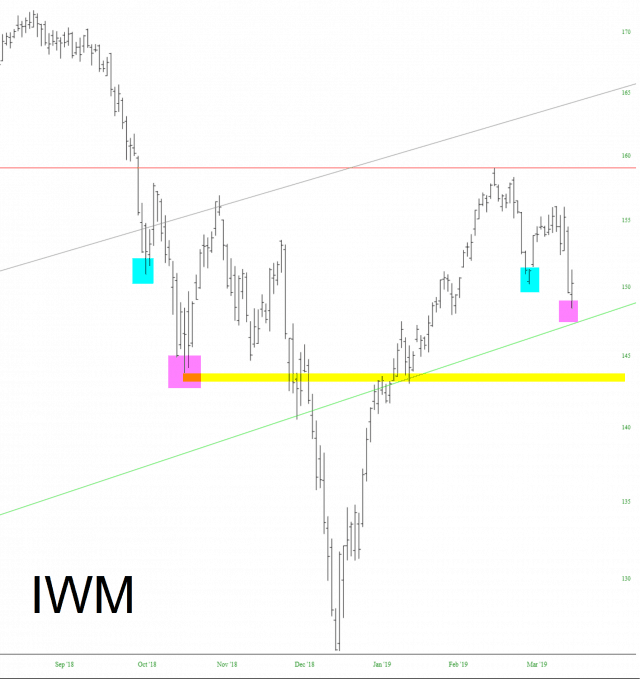

In order for the bears to get another bit of fun, we’re going to need to break the yellow tint I’ve shown above, thus dispatching the risk of an inverted head and shoulders bullish reversal.

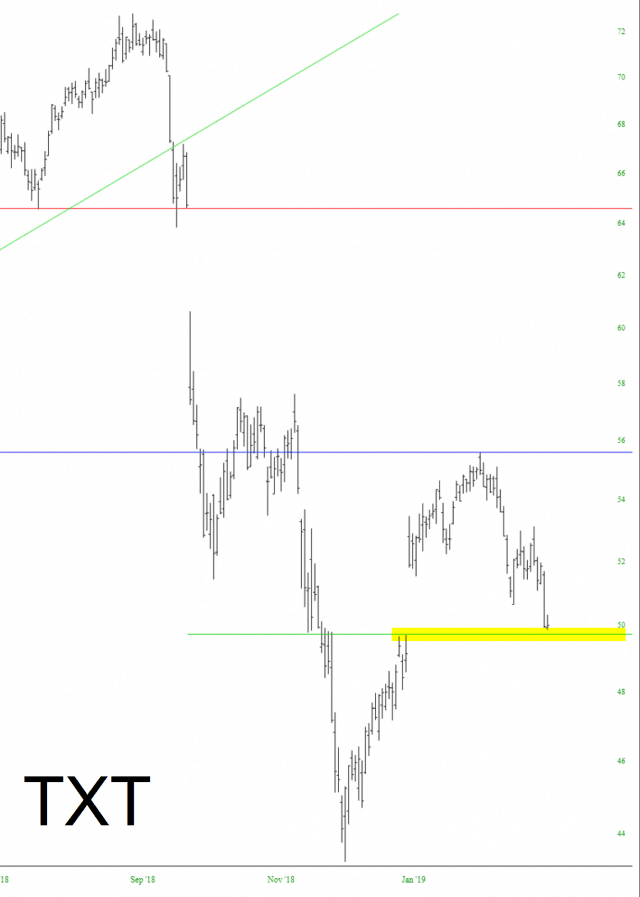

The chart below, one of the many I covered this morning, is representative of the kind of short whose time may, for the moment, be over. Notice how cleanly it closed its price gap. I’d be pleased to get back into it again, but only at a safer (higher) price.

In sum, I have gone from 60 short positions down to a mere (!) 43, and I’ve freshened all of my stop-loss prices in order to improve the risk/reward ratio across the board.