Greetings from Revolution headquarters! I am excited to be back in the friendly confines of Middle Tennessee, after a week of travels. The faithful Reverend of Tennessee has heard your cries, and is ready to take a look at our favorite shiny metal.

The gold miners have enjoyed a solid, albeit tempered, uptrend for the past seven months. After a rough end to this week, I started to hear the fear-mongering begin from the corners of the Slope. Oh ye, of little faith. As we enter a new month and quarter, come walk with the Rev and let’s find a way to profit.

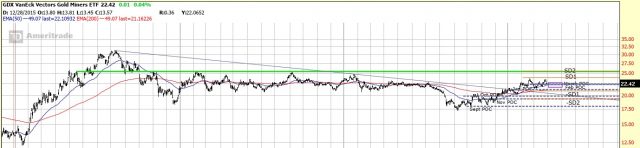

First things first… Let’s take a look at the current daily chart of GDX. Going into the new month I find a few interesting guideposts to monitor.

- March POC is set at 22.40, clustering nicely with Feb POC at 22.30. After two months of sideways consolidation, the 22.30-22.40 area will be the key pivot for April

- GDX in March continued to see higher lows, bouncing off the 50 day moving average. This is bullish, and the 50 day should continue to be monitored for areas of support going forward.

- Value area for March sees a tight range between value area high of 22.77 and value area low of 21.75. Above/below those levels should give good direction for the remainder of the month.

We’ll take a look at both the bullish and bearish cases for GDX in April. The bullish case sees first upside target at monthly SD1 at 23.96. This coincides near the February highs, and should offer a first level of resistance if we break to the upside. The second area of resistance, and what is my preferred monthly target for GDX in April is the 25.50 area at monthly SD2. As you can see from the chart below, this level is a key support/resistance level going back three years.

From the bearish perspective, a break under the Feb/March POCs would be key. If that were to occur, there are two key areas of support that I would look to this month. First would be the January POC at 21.17, which will coincide this month with the 200 day moving average. Below that would be first support at the cluster of the Nov POC at 19.31 and the monthly –SD2 at 19.34. If GDX were to test this cluster during the month of April, it would be the time to cover shorts/buy longs from a trading perspective.

I hope that gives both traders and investors a framework to attack GDX from this month. GDX remains in an intermediate term uptrend, thus I continue to expect gains in the coming months. After the end to this week, GDX is currently in a short term ATR downtrend, and would reverse back into an uptrend with a close above 22.80, which would also be a breakout of the value area to the upside. If you are trading, 22.80 would be the level I want to buy above, and look to take profits at the levels I mentioned above.

Enjoy the GDX Volcano!