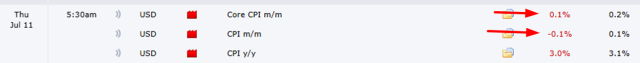

The CPI numbers are out and, in spite of everything your eyes tell you, prices are FALLING. This gives the all-clear for the Fed to make the rate cut we’ve been hearing about since the beginning of time, since these government-created numbers came in ice-cold.

The effects have been instantaneous. The small caps /RTY blew higher.

The USD/JPY collapsed.

Bonds (/ZB) soared to major resistance.

The only, and I do mean the ONLY, good news for me this morning is UAL which, thanks to DAL, is getting hit hard. It is my biggest position, but not big enough to make the opening bell today positively suck.

Bears seriously haven’t gotten a break for two solid years now. Lifetime highs will be seen across the board today.

One last thing I’ll mention, if I may, is that the notion that interest rate cuts lead directly to equity strength is completely backwards. I offer the layered chart below which shows, in black, the 30 year rate and, in blue, the S&P 500.

Slashing rates, more often than not, means the Fed is desperate to stimulate the economy, and the reason they do this isn’t because things are peachy……..it’s because things are about to get tough.