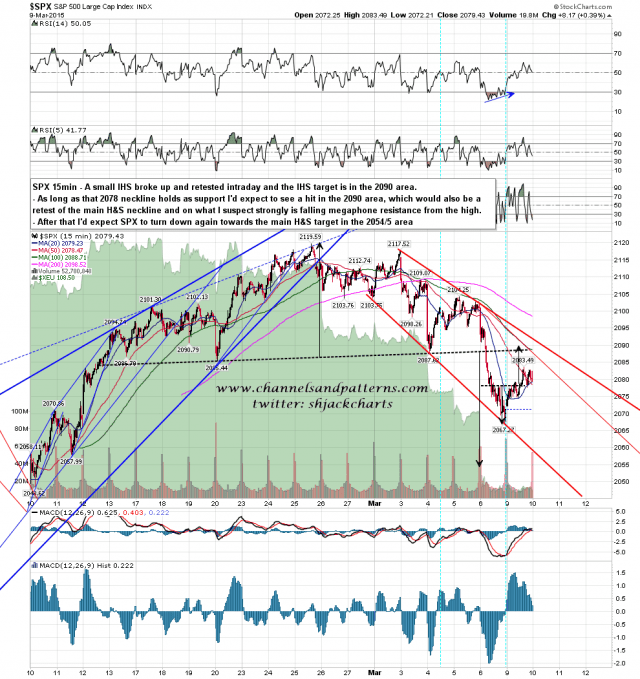

I had a great looking setup in play last night, and I did the chart and saved it with some confidence that we would see an extension of the rally into the 2090 area today, and then fail into the H&S target at 2054/5. That setup was supported by an IHS that broke up yesterday morning, and clear declining resistance from the highs at the IHS target. That chart is below. SPX 15min chart:

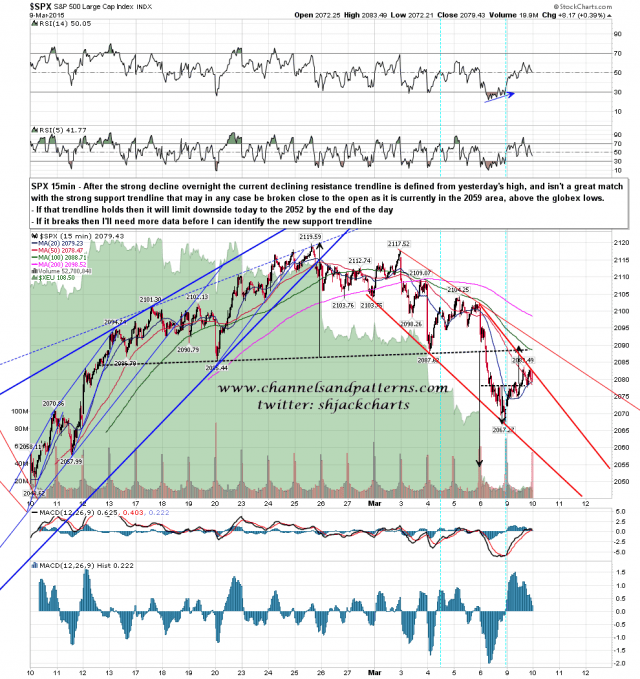

Alas it was not to be, unless we see a rally back to yesterday’s close by the open, which looks unlikely. Instead we now have a new declining resistance trendline, and the same strong support trendline that will be in the 2059 area at the open and the 2052 area by the close. Unless that trendline breaks then further downside today will necessarily be limited, though the 2054/5 H&S target will be above that trendline by this afternoon. SPX 15min:

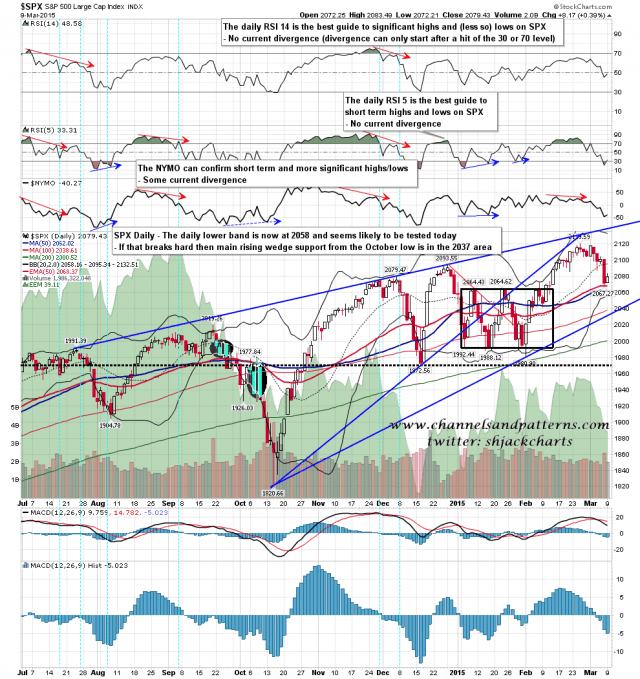

This unexpectedly determined overnight decline has left me less certain that SPX is going to reverse back up after the H&S target has been made, but there is decent support at the daily lower band at 2058, stronger (but weekly closing) support at the weekly middle band at 2057, and I have main rising wedge support from the October low in the 2038 area. On my scenarios where SPX makes new all time highs this year, it would help a lot if that wedge support wasn’t broken, or ideally tested, in this move down. A break below would open up more bearish options. SPX daily chart:

We may well see an early rally today and if we make the H&S target at 2054/5 today, I’d be expecting that to be this afternoon.