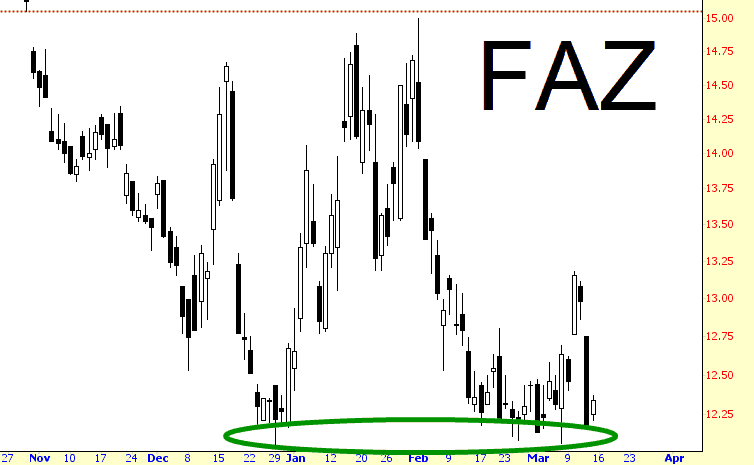

If you’re looking for an interesting (and aggressive) opportunity, triple-bearish ETF (based on financials) symbol FAZ is available. On a split-adjusted basis, this poor creature has dropped from $40,372 down to – – incredibly – – twelve bucks. All the same, that’s an interesting double-bottom in place. (Side note: I’ll be doing a variety of videos for everyone, including some exclusive Slope+ entries, this weekend).

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

March Mai Tais

Where’s the Fear?

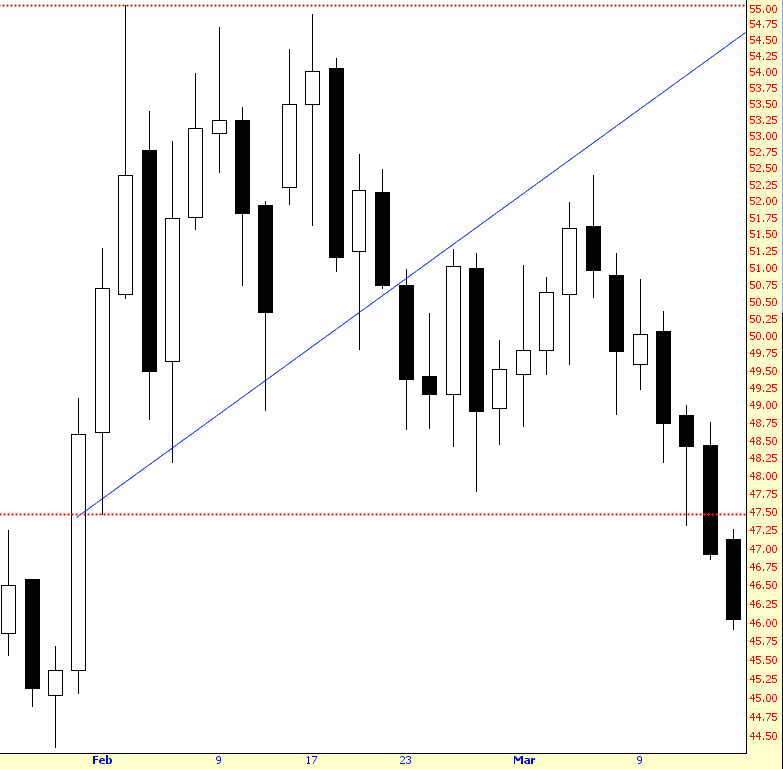

The market has fallen a little over 3% since it hit its highs and in the new bull fed supported market this is considered a crash, there is an overall lack of fear this decline compared to the last declines. Looking at the chart below you can see that the VIX index rallied at least 40% before the market bottoms. The stepper the decline the larger the drop but on average the VIX climbed 86%. So where are we now. Well the market has declined around 3.9% and the VIX has climbed about 35%. So what does this all mean, well it means there is a strong possibility that the market has another 2-3% decline and the VIX has another 5%-10% rally before we can start thinking a bottom has been put in. Of course the markets can prove us wrong but history does repeat its self. Click the chart to zoom in. (more…)

Bulls Need to Follow Through

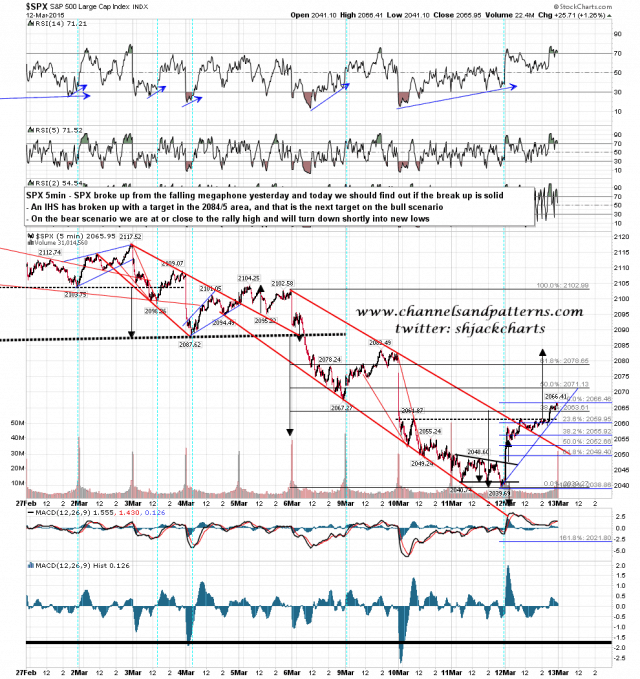

A very solid bounce off main rising wedge support yesterday, and an IHS broke up in the afternoon with a target in the 2084/5 area. If the bulls can follow through today then that is the next big target. SPX 5min chart:

Cramer’s Sense of Smell

I don’t think there’s been a blogger roaming the streets of Palo Alto more bearish on crude oil than me, and to date, that has worked well. Cramer famously announced a few weeks back that oil’s price “smells like a bottom” (which, again, is the kind of olfactory proclamation that passes for analysis, versus my carefully-crafted charts). I personally think the prospects for energy smell more like Cramer’s own bottom, but we shan’t explore the topic further.