Apologies for the very late post today. I had an appointment that overran badly & missed the open. That was annoying as I was short from the globex highs and missed the very well signalled low, but that’s the way it goes.

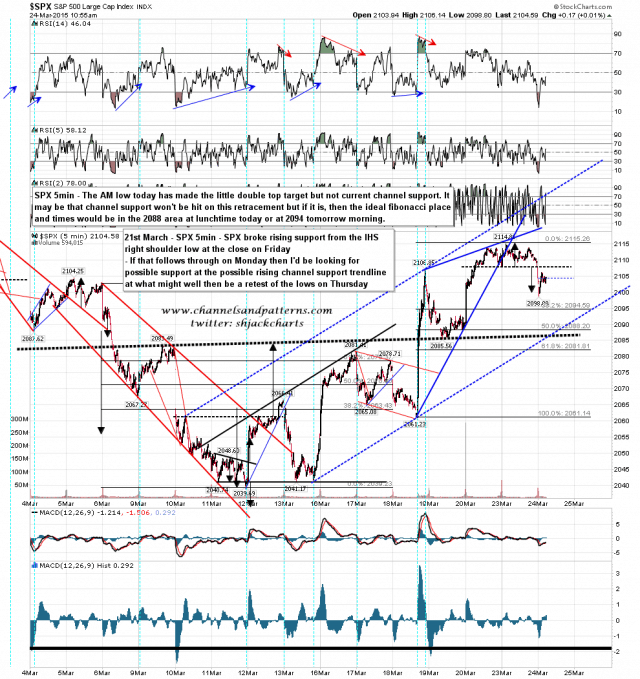

Was that the low for this retracement? Well it made the little double top target left over from yesterday, but fell well short of hitting rising channel support. That looks like unfinished business unless we see a strong break back up, and if that support is going to be hit on this retracement, then the ideal fib time/place hits would be the 2088 area at lunchtime today or the 2094 area tomorrow morning. If SPX breaks back up hard then this rising channel has evolved into a rising wedge and the next upside target is the same pattern resistance trendline, currently in the 2125-30 area, so already in the right target area to make the IHS target there. SPX 5min chart:

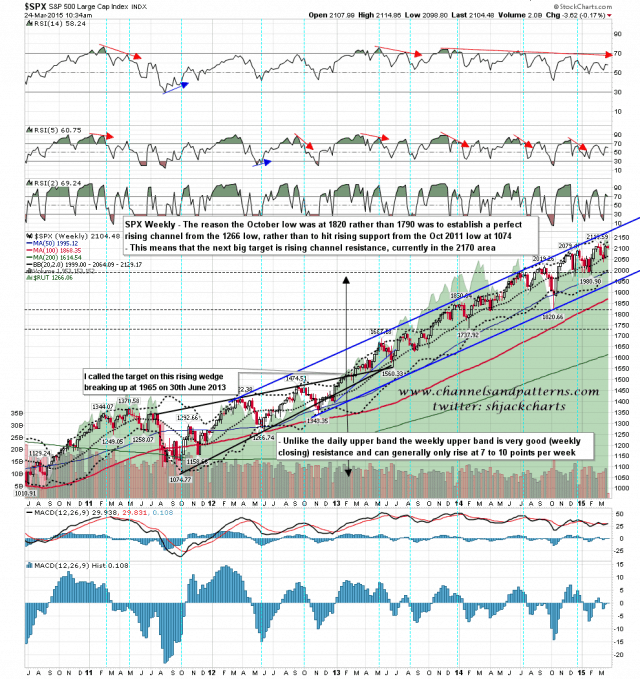

One of the real oddities of the last few months for me was the October low being in the 1820 area, rather than making the obvious target in the 1790 area at rising support from the October 2011 low at 1074. I should have realized earlier, but the reason was that the October low established the lower trendline of a perfect rising channel from the 1266 low. This means that there are two primary trend patterns from the October 2011 low rather than the usual one, and it also means that the next intra-channel target is at channel resistance, now in the 2170 area. The odds of hitting that target before the next big retracement are therefore higher than I had previously thought, though it was always in play as a target of course. SPX weekly chart:

Unless we see SPX break back over 2110 I am leaning towards seeing a lower retracement low at channel support on the 5min chart. Unless we see a break below that channel support that should be a very nice looking long entry, if seen.