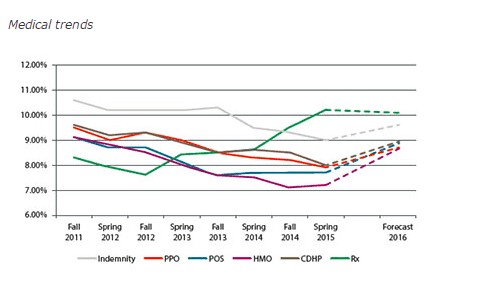

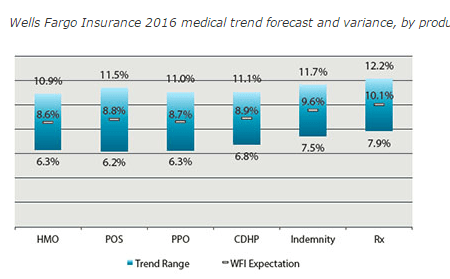

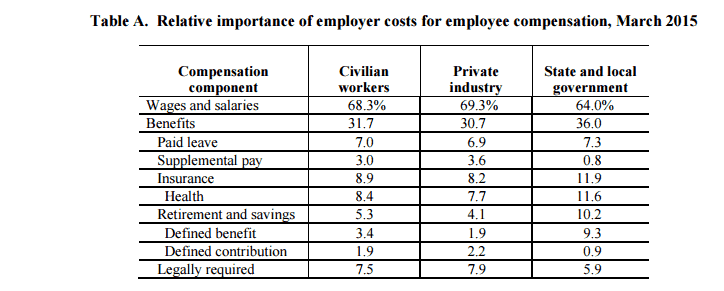

Going into 2016, the data points to a 9-11% increase in healthcare costs. Let’s not get bogged down into who will bear this cost, let’s just agree it will not be good for Employers, consumers, and State Budgets.

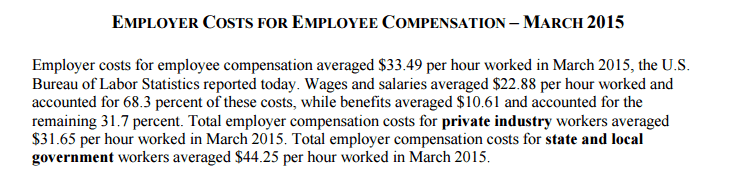

The GDP of the U.S. is approximately $17 trillion. Healthcare is 17% or approx $3 Trillion. This increase transfers $200 billion additional dollars out of consumers (as a tax, or employers as a cost, or States as an expenditure).

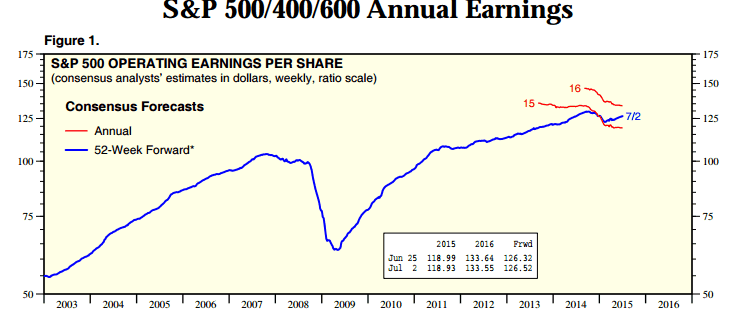

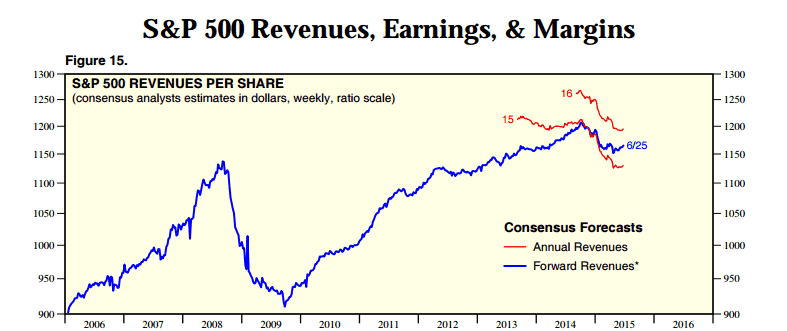

This is on top of an expected flat to 2% revenue growth expected next year. Consumers will stop spending on other things or take the tax and drop out, employers must grow $10 dollars of revenue for every dollar of the increase they will absorb, to simply keep EPS the same. At 8% of GDP for Employer portion of Health costs, that is $100 billion in new revenue. That is nearly a 6% growth in Revenue just to run in place.

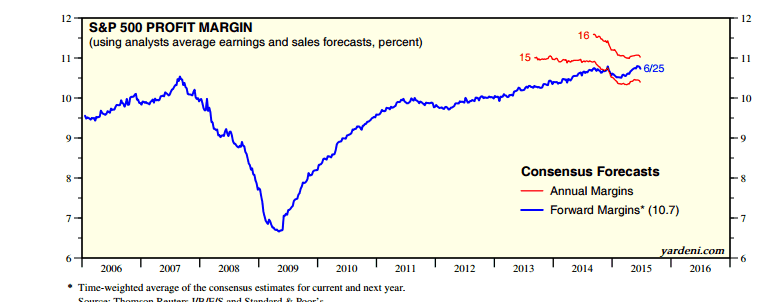

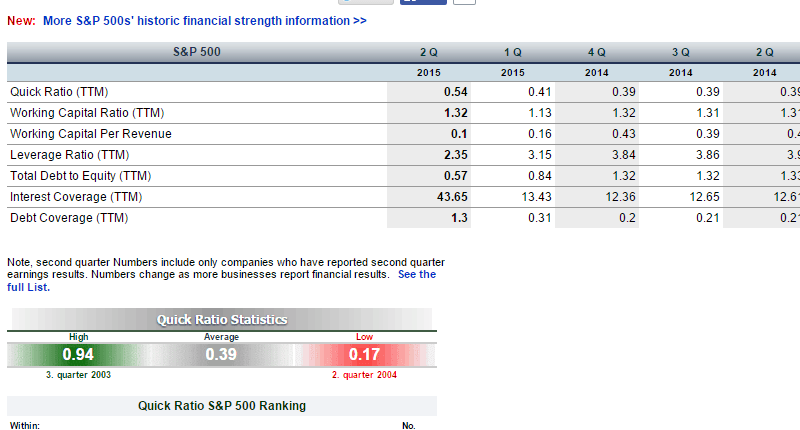

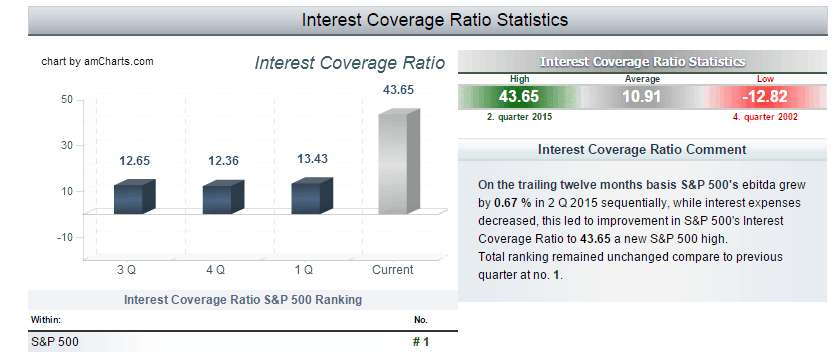

Margins are at record highs so cutting to prosperity is already over, and Debt to equity pushing on the high end of the spectrum and Interest rate coverage at record highs, cant see the stock purchase thingy rescuing the market in 2016. Oh, and interest rates are at zero, so no help there. Healthcare is a tax in people’s mind so it will drop velocity even further as people get scared the stop spending at a higher proportion to their actual cost (animal spirits, don’tcha know).

We are already seeing commodities coming off, and if I was a stock picker I’d start looking at areas that have high elasticity of demand, as people will have to cut somewhere. I also expect incredible scrutiny around these high cost Biotech drugs as the top ten drugs cost over $100 billion a year. Trouble seeing the lining here.

If someone can point to the fairy dust that catapults us into new highs, please tell me how. I ran out of math.

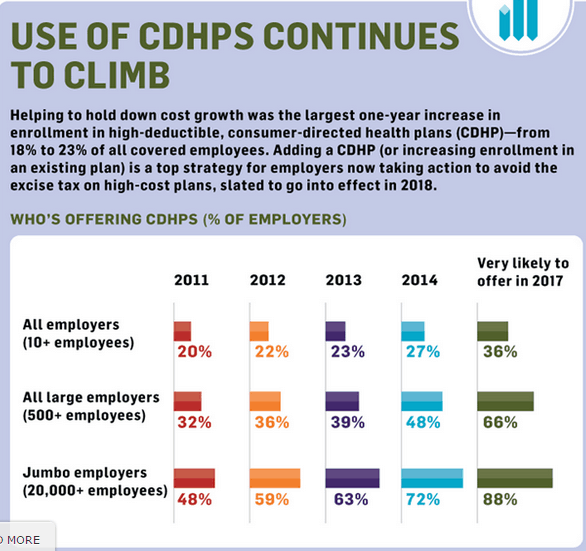

Below are my charts as reference.

I post daily commentary and have a paid signal service at http://bobsstocksignals.blogspot.com/

I post daily commentary and have a paid signal service at http://bobsstocksignals.blogspot.com/