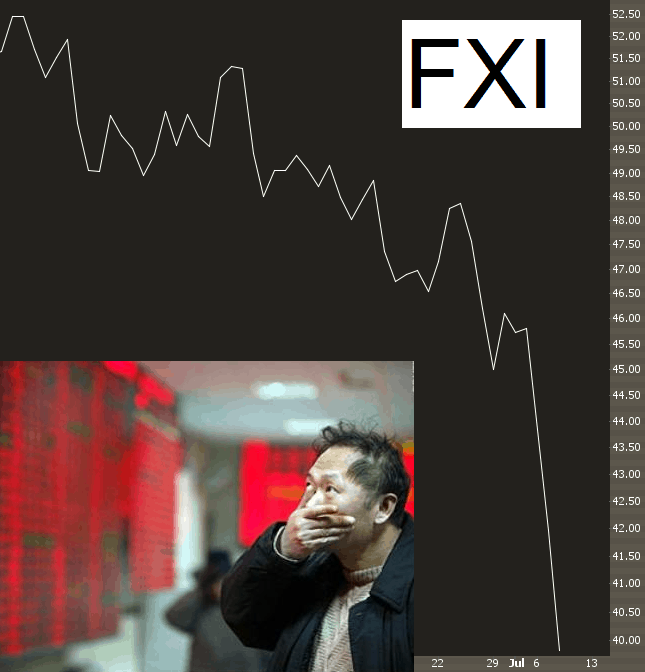

Further to my post of June 8th, here’s what has happened, since then, on China’s Shanghai Index.

After making a slightly higher high of 5178.19 on June 11th, it has since plunged to a low today (July 8th) of 3421.53 to close at 3507.19…slightly above its 200 Day Moving Average — making a loss of 1671 points from high to close, thus far.

The first level of major supports sits around 3000…the next around 2500…a solid break and hold below 2000 could cause major panic in markets around the world.

So far, attempts by the Chinese Central Bank to intervene and stop this falling knife have failed…we’ll see if this market can find any stability at any of the above-noted levels. There are no “buy” signals at this time on the RSI, MACD, and Stochastics indicators — rather, they are still bearish, although quite oversold; however, the extreme bearish force of the MACD, in particular, should be respected, as we could, very well, see much more selling in the short term.