Most of you have probably gathered I’m not big on vacations. If I had committed some ghastly crime and was sentenced to spend the rest of eternity working from home, forbidden to leave the town limits of Palo Alto, I actually would have no problem with that. Indeed, I’d like to know the crime in question, just so I can enjoy committing it and then bask in the glow of a supposedly Draconian sentence.

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Swing Trading Watch-List: ABT, ALGN, DHI, HBI, TXT

Limp Direction

Greetings from a poolside in Orlando. I have just a few hours of my ostensible vacation left, and I’ll be composing a post about it for publication late today.

I’m having a not-at-all bad time in the markets. Yesterday I lost a very tiny bit of ground in the face of a hefty rally. Today, even with the ES green (and the NQ very green), my 63 shorts are serving me well, yielding firm gains in the face of perpetually moronic bullishness. I applaud my chart champs.

The Triangle Issue

The move up this week hasn’t gone quite as I expected. As I said on Monday morning, there were and are 90% odds that the triangle that broke up on Friday would make a thrust out that would be fully retraced within days back to, depending on the draw, at least the 2080-5 area. I was expecting that retrace on Monday or yesterday, to be followed by another move up, but it hasn’t happened yet.

There is obviously a 10% chance that the triangle retrace won’t happen of course, but 90% odds are really pretty high so I’m assuming that we will see that retracement until demonstrated otherwise.

Iran’s Crude Effect

Just a quickie comment-cleaner as we await something more pithy from Springheel Jack……..

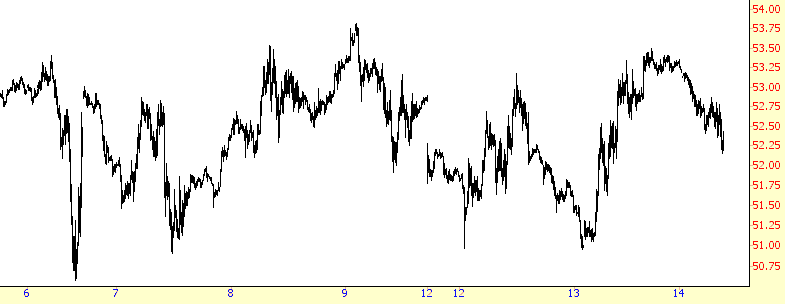

I remain bearish on energy and energy-related stocks. Crude has been stuck in a very tight range for the past seven trading sessions, following the big drop of July 6. The historic deal with Iran is obviously suppressing prices, since a tidal wave of oil from Iran in coming years will just add to the supply glut. As always, this is just background noise to the charts, though; keep an eye on a failure of Tuesday’s lows to get the tumbling resuming: