My “try to be a partial bull” yesterday blew up in my face. Not to be vanquished, I gave it another go today, and it’s working out (so far!) My best winners have been XOP and XME, and I’ve got a smattering of other long positions. In addition, I’ve trimmed back substantially on my shorts.

Having said that, let me be really, really clear: I think the Short Setup of 2015 is coming soon. I intend to hang on to these longs for a while, but they are, ironically, going to be my short signal when they reach their targets (well, let’s be humble – – IF they reach their targets).

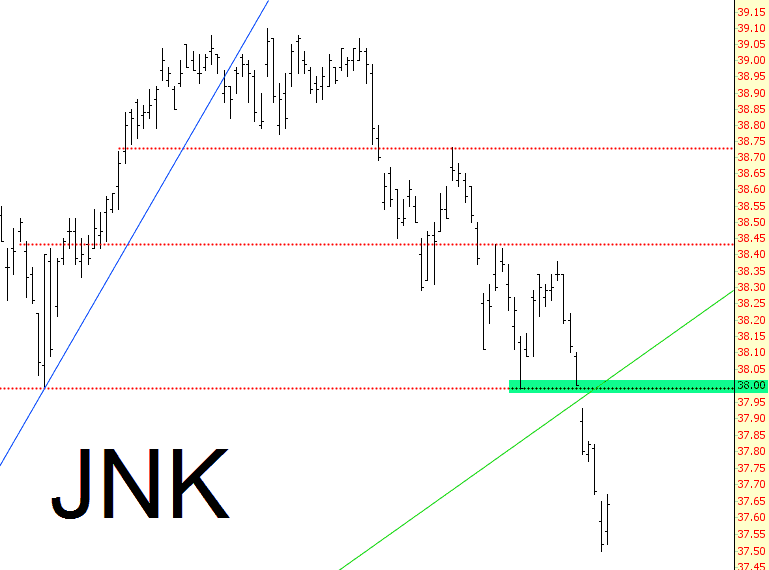

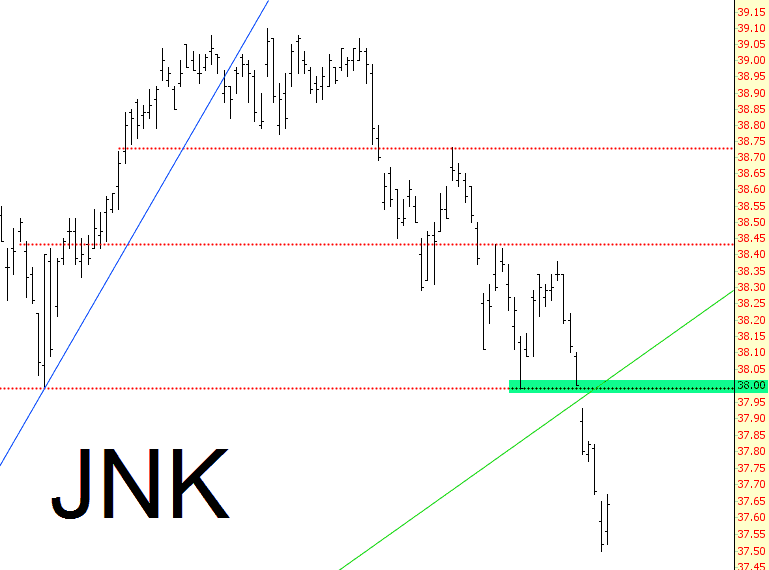

One other helpful chart that I think will be the “all clear” for bears is JNK, shown below. If we can hack our way back to the level shown (and perhaps tomorrow’s Fed meeting will do the trick – who knows………) I intend to be obscenely and pornographically short. Until then, I’m in a relatively “balanced” portfolio, and crude oil in particular is being very helpful right now.