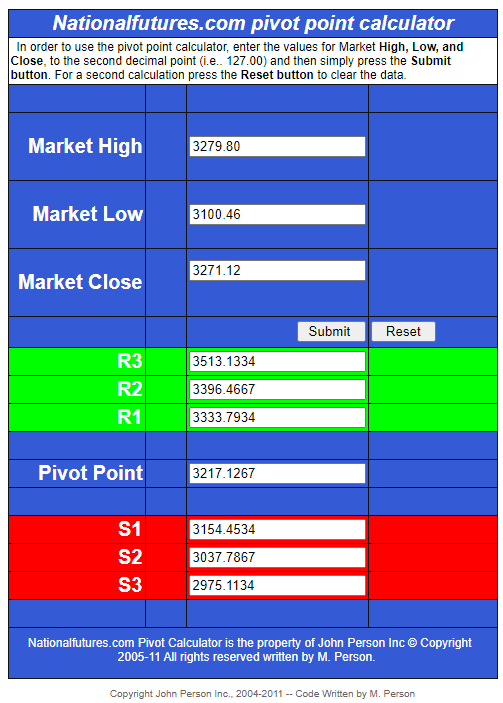

The pivot point support/resistant values/targets for the S&P 500 Index (SPX) for the entire month of August are based on the high/low/close of the July monthly candle, as shown on the following pivot point calculator.

(more…)Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

SPX Pivot Point Values for Week of July 20

The pivot point support/resistant values/targets for the S&P 500 Index (SPX) for the week of July 20 are based on the high/low/close for the July 13 weekly candle, as shown on the following pivot point calculator.

(more…)SPX: Alligator’s Jaw Shuts…Higher Prices Ahead?

Further to my post of June 29, the jaw of the William’s Alligator has shut and two of the three moving averages (each offset into the future) have re-crossed and turned up, as shown on the following SPX daily chart.

As well, the Awesome Oscillator has flipped above the zero level.

Both of these are hinting that further buying may be in store…I’d need to see the third moving average turn up to confirm potential strength.

However, the Balance of Power is still with the sellers, albeit somewhat tepid, so, unless we see this flip to the buyers on this timeframe, we may be in for a bit more weakness before we see sustained buying resume.

(more…)DANGER: Alligator Crossing on the ES

Further to my post of June 21 with respect to the SPX, I’d just mention that the three moving averages (each offset into the future) forming the Williams Alligator on its counterpart S&P 500 E-mini Futures Index (ES) have all crossed to the downside, as shown on the following daily chart.

As well, the Awesome Oscillator has just turned negative in Sunday’s overnight trading.

Both of these are signalling potential further weakness ahead.

(more…)