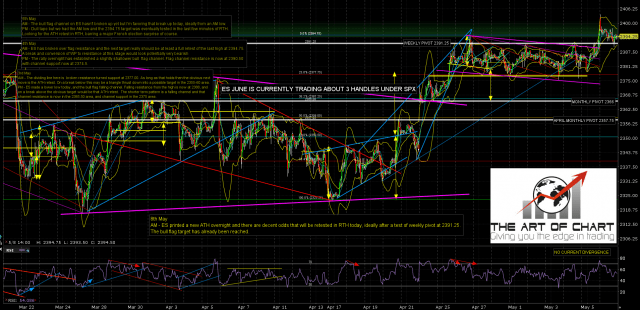

ES made a new all time high overnight and SPX has made a very marginal new high this morning. I regularly hear that highs made in globex are always retested in regular trading hours, and that isn’t true, and is demonstrated to be untrue on a regular basis, but these globex highs are retested at least three times out of four, and most likely we’ll see that here.

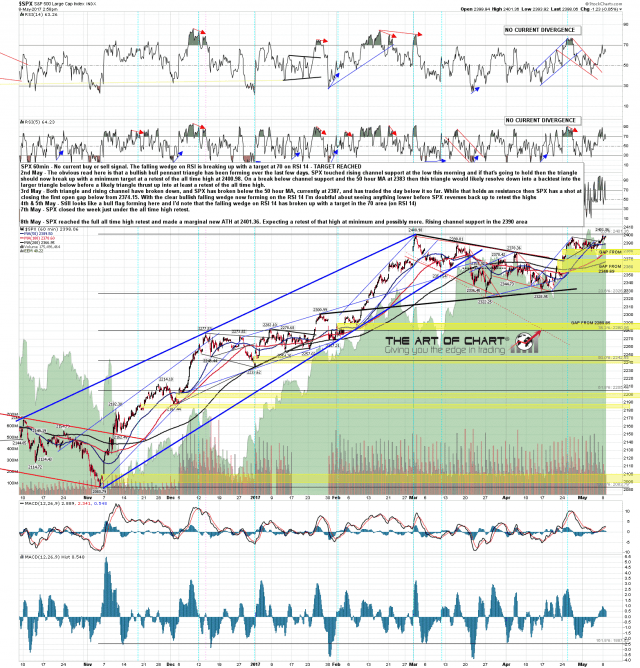

SPX has a decent rising channel established and rising channel support is in the 2390 area. That’s in the same area as the 50 hour MA, and I’m expecting that to hold until this move enters the topping process. SPX 60min chart:

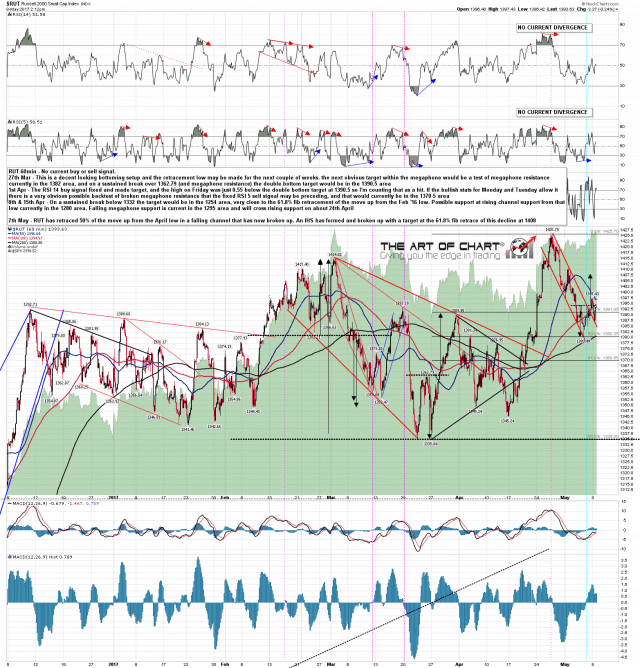

The clearest pattern setups, as is regularly the case, are on RUT, and there is a clear target at 1407 there, at the 61.8% fib retracement of the decline from the high. I’m expecting that target to be reached. If that level can be broken with conviction then RUT may well retest the ATH to make a likely second high of a double top. RUT 60min chart:

On ES I was writing before the open that the weekly pivot at 2391.25 would likely be tested in the morning, and it was, and that ES might well retest the globex high from there today. That didn’t happen but the odds are decent that will happen tomorrow. The retracement from the globex high looks like a bull flag and as long as the weekly pivot holds as support, a bull flag is what this is. ES Jun 60min chart:

Stan and I are expecting to see a marginal further new ATH that runs up another few handles. Obvious target areas are the daily upper band in the 2415 area, and the weekly upper band in the 2430 area. After the next new ATH though, the swing high should be close. We were talking about this among many other things yesterday on our monthly public Chart Chat at theartofchart.net. If you’d like to see the recording then you can see that on this page here.