A quick glance at ZeroHedge this morning tells me that being in the bad news business is awfully tough these days: with Emmanuel “Clinton” Macron winning France, equity markets at lifetime highs, and no meaningful geopolitical turmoil, there aren’t many coals to stoke. Indeed, they’ve resorted to running stories about what a dangerous city Baltimore is, which is like me writing a header post about why ill-fitting shoes are uncomfortable.

I have had a happy distraction in the form of SlopeCharts, and judging from how much Slopers are using them, I’d say it’s off to a great start. I keep emphasizing “this is just the beginning”, and if you saw the list of features I plan to add, you’d know it’s true. It has been over a dozen years since I’ve had a chart platform to control, improve, and expand, and it’s an extremely liberating feeling for someone like me. By the time I’m done, the other chart platforms on the web will be embarrassing

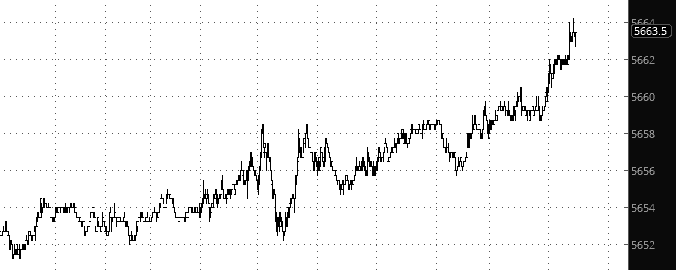

As for the markets, meh-a-pooloza, here’s the NQ, which is on the most placid, calm, steady ascent to infinity I’ve ever witnessed…..

Apple’s record high yesterday fueled the fire, and who knows, maybe it will be the first trillion dollar company in history. It only has to grow 25% more to get there.

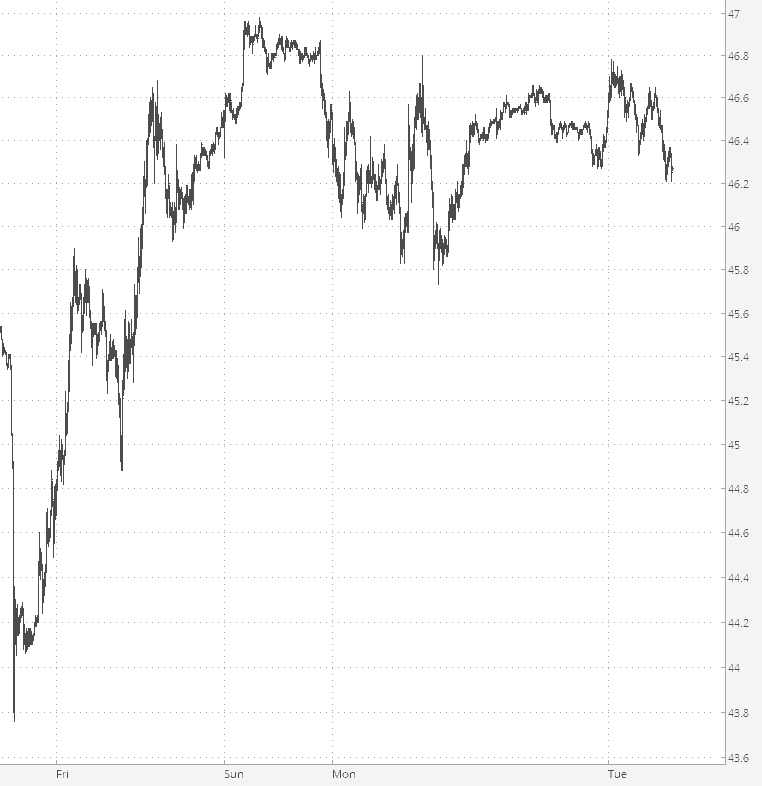

My portfolio is fairly thin right now (30 positions) and remains tilted toward energy shorts. Crude oil is down a little right now, and of course I don’t expect any meaningful movement until Wednesday morning, when the inventory report comes out.

I’ll be up more specific short ideas over the course of the day. Good luck to you all in this VIX=9 environment of ours!