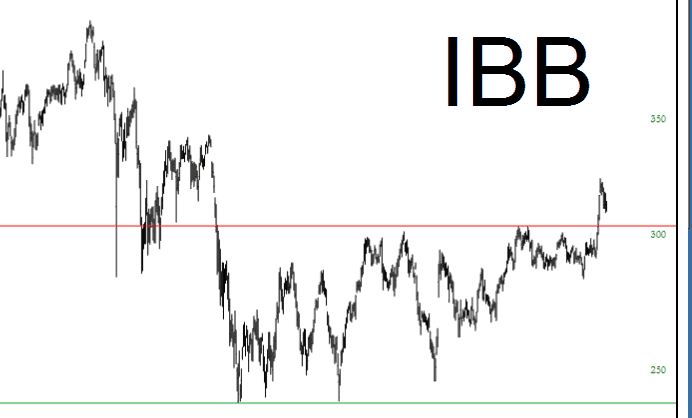

During last year’s insane election, Trump made big claims about really taking drug companies to task, reigning in the crazy expenses of medicine, and in general giving the overpaid makers of drugs the kind of smack-em-up they all deserve. Well, right on the heels of his rousing success building a border wall (and having the Mexicans pay for it), completely overhauling the tax system, and sending Hillary to jail, he has, on top of all those successes and promises kept, beat the stuffing out of the drug companies, including the entire biotech sector………