Sigh. This market just can’t get any traction. No, let me correct that. It can’t get any downside traction. Every time I think that, at long, long last, we’re going to start going lower – – it’s over within a day. It’s disheartening, to say the least.

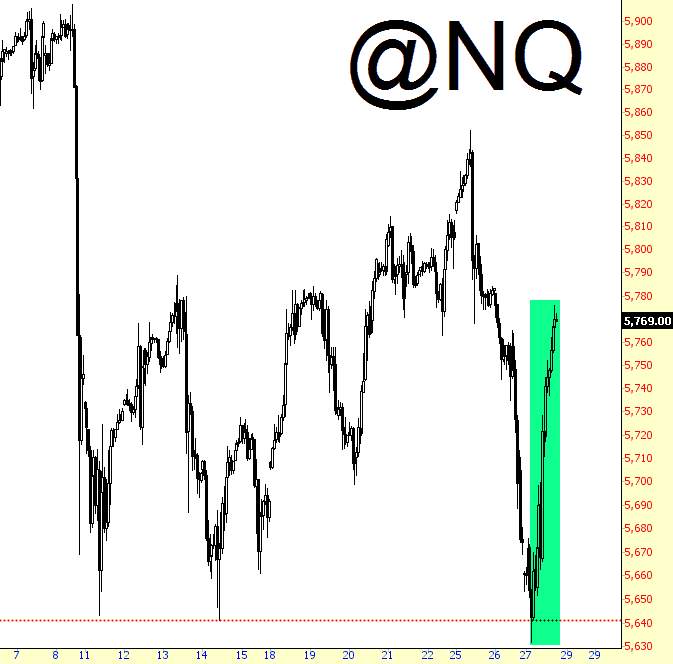

The past couple of days, of course, are what I’m referring to, since he had a nice beefy tumble on Tuesday……..and some great follow-through for a few hours (on the NASDAQ, at least) late Tuesday night. By end of day Wednesday, however, it was all over. Just LOOK at this madness!