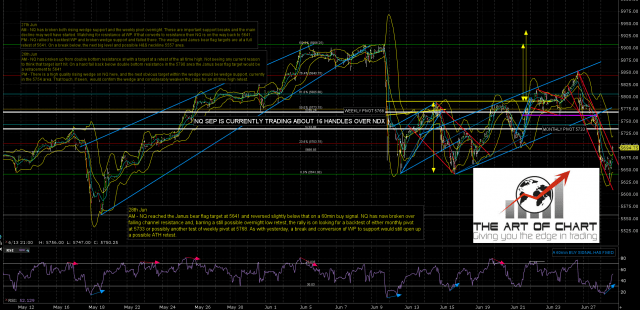

That was a very nice day on NQ yesterday. I was looking for resistance at the weekly pivot at 5768, and the RTH high was 5764. The target on a fail was 5641 and that was slightly exceeded in globex (buffs fingernails modestly) before the start of the rally that we are seeing today. Does this mean that the seventh seal has been broken and the Bearpocalypse has begun? Um … no, but this swing high may well finally be in, subject to what we see on these rallies/backtests.

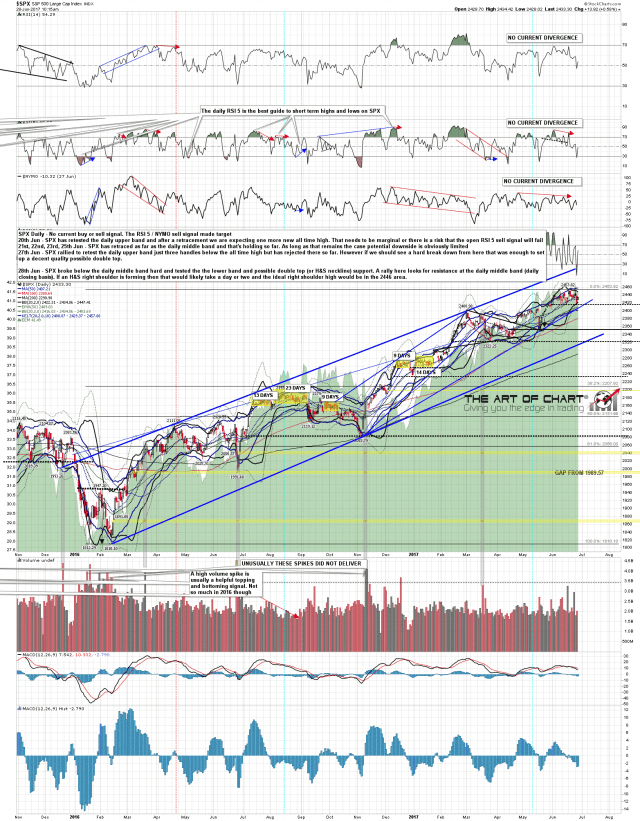

On SPX the obvious resistance is the daily middle band (daily closing basis). That’s being tested at the moment. SPX daily chart:

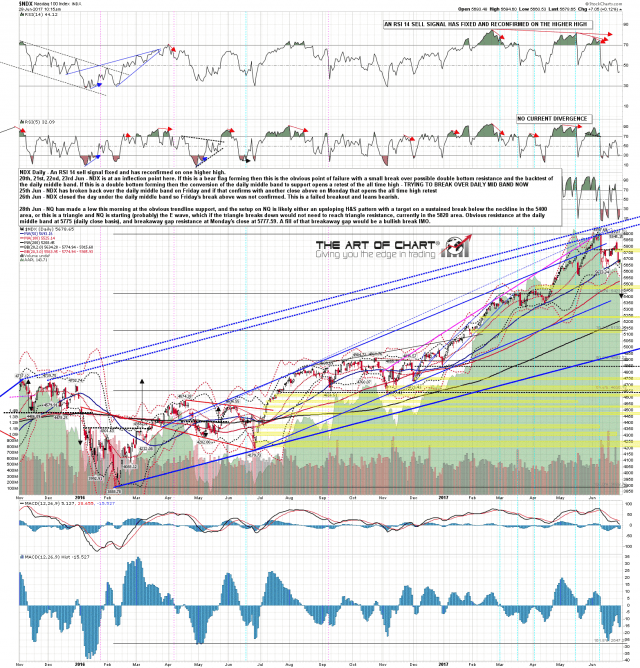

On NDX the daily middle band should be a backstop rather than a strong target here. That’s at 5775 with breakaway gap resistance there into Monday’s close at 5779.59. If the swing high is in on NDX then that gap should not be filled. A gap fill opens up a possible all time high retest, in what would likely be the second high of a double top if seen.

It was easy to miss if you were watching the big gap up on SPX today, but NDX only delivered a small gap up today that was quickly filled into lower lows under yesterday’s lows. The current low on NDX is an exact touch of an important trendline that is support on one of two likely patterns here. Option 1 is that NDX has completed forming an upsloping H&S there that on a sustained break below the neckline would look for the 5400 area. Option 2 is that the trendline is support on a classical symmetrical triangle which would likely be starting Wave E here. If the triangle is going to break down then there would be no need to retest triangle resistance, currently in the 5820 area. I’m leaning towards the H&S option. NDX daily chart:

The ES and NQ futures charts below were done after the RTH close for Daily Video Service subscribers at theartofchart.net. If you are interested in trying our services a 30 day free trial is available here.

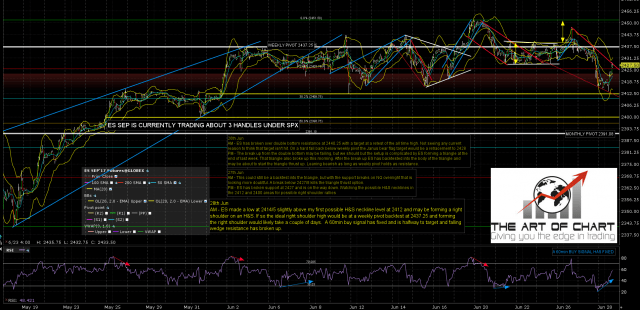

On ES key resistance on this backtest is the weekly pivot at 2437.25. Bulls failed to convert that to support yesterday and need to fail again today for the downtrend to resume. The 60min buy signal that fixed overnight has reached target. ES Sep 60min chart:

On NQ Stan gave the ideal backtest target in his video last night (for daily video subscribers at theartofchart.net) at monthly pivot at 5733. The HOD on NQ so far on NQ is at 5728/9 so that’s being tested now. The 60min buy signal that fixed overnight has not yet reached the possible near miss target. NQ Sep 60min chart:

On TF the double top broke down and made it halfway to target before reversing hard with ES and TF broke back over key resistance at the weekly pivot at 1409.7. I was warning in my premarket video this morning (for daily video subscribers at theartofchart.net) that if weekly pivot was converted to support then TF would likely retrace back to the last high 1420/1 (another Janus flag), and TF has done that. Possible all time high retest coming on TF. TF Sep 60min chart:

I’m leaning towards a bearish resolution at these backtests, and we’ll see how that goes. The rallies on ES & TF have been strong, but it feels like a bear market rally, and TF leading, closely followed by ES with NQ trailing at the back isn’t a bullish looking sequence. I am concerned about the holiday weekend approaching though, we’ll see.