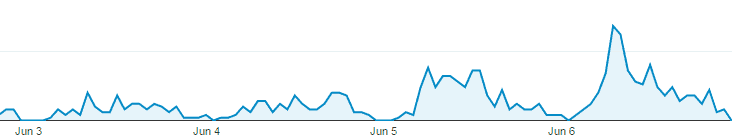

Well, at least there is one strengthening chart around that I applaud, and that is the usage data for SlopeCharts. It’s getting stronger by the day, and I’m delighted to tell you that multiple new technical indicators will be announced soon, free to all users. I’m so pleased people are embracing the product. As I’ve said, I run a seven-figure portfolio based on nothing but SlopeCharts, so my trust for it is quite deep.

As for the markets, crude oil’s plunge this morning has been a wonderful elixir, turning an ugly loss into a nice little profit (at the moment). Let’s keep it going!

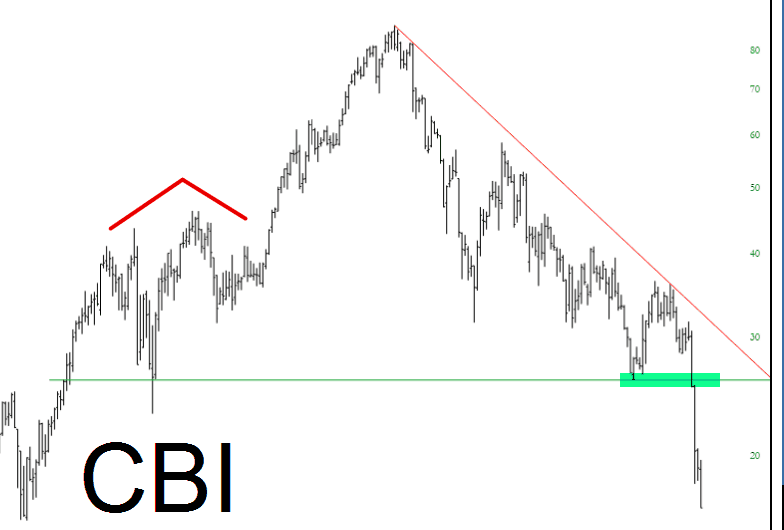

I presently have 66 short positions, 59 of which are profitable as of this writing.