I was saying on my twitter at lunchtime that the 70% option was a fail at weekly pivot resistance and the 50% retracement level on the NQ chart, and that duly delivered after a slightly nonplussed pause after the FOMC rate rise at 2pm as the market tried to work out whether such a heavily trailed announcement qualified as news and, if it did, whether such expected news could really be a credible reason for markets to react to it. Honestly I have no idea what the answers to those questions might be myself, but the setup favored the bears regardless and duly delivered the reversal at obvious resistance.

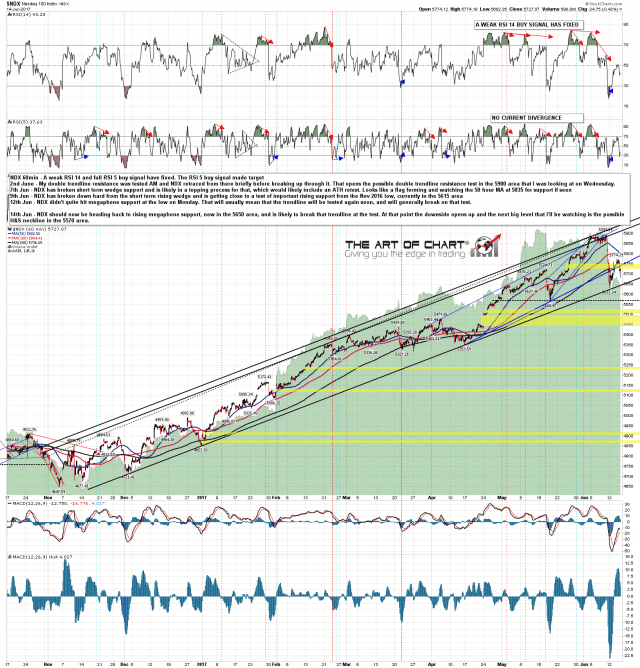

Key trendline support on the NDX charts is megaphone support currently in the 5650 area, and the near miss at the last test is suggesting strongly that will break on the next test. NDX 60min chart: