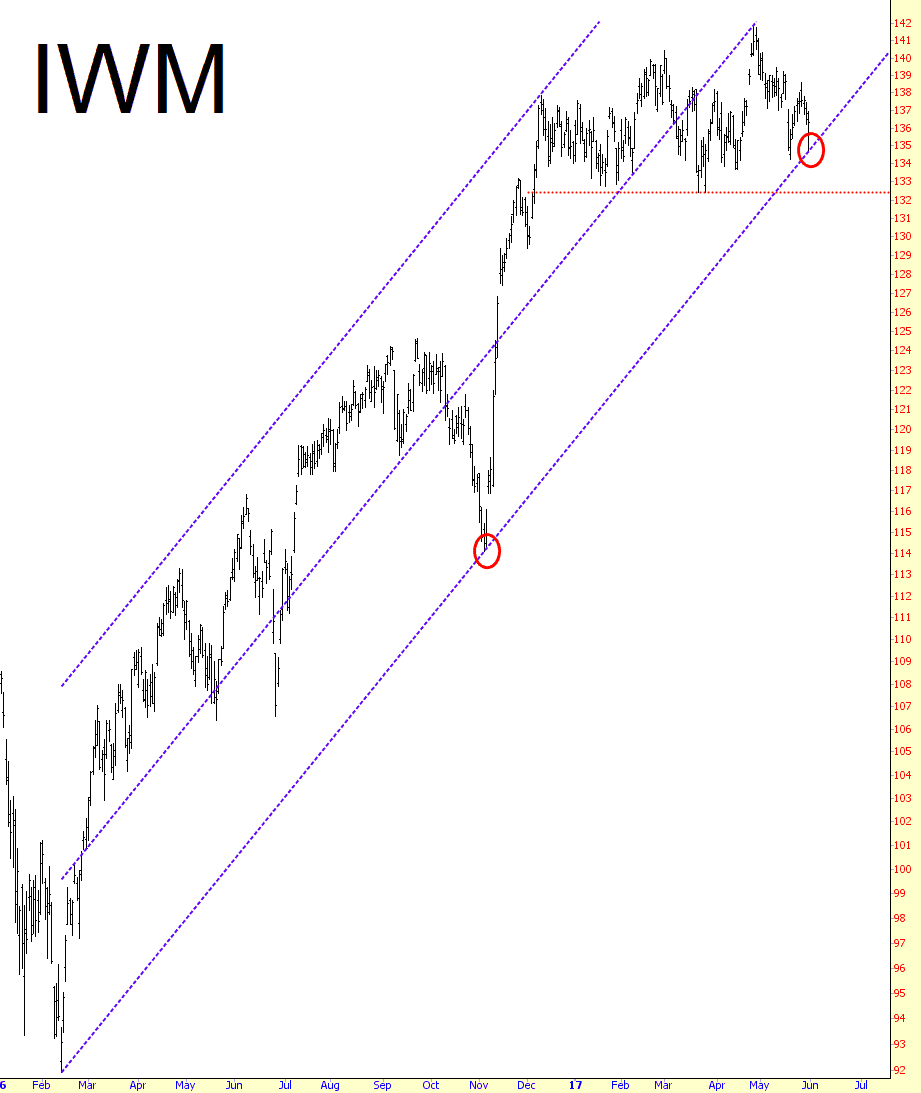

indexes like the S&P 500 and Dow Industrials were at lifetime highs just yesterday, whereas the small caps have been lagging fairly badly. What’s interesting to me is the channel on the small caps, shown by way of fund IWM. As you can see, the last time it tagged this lower channel trendline, it rallied mightily (that was, of course, just before the election). Let’s see what happens in this instance, because a trendline break could be a game-changer.