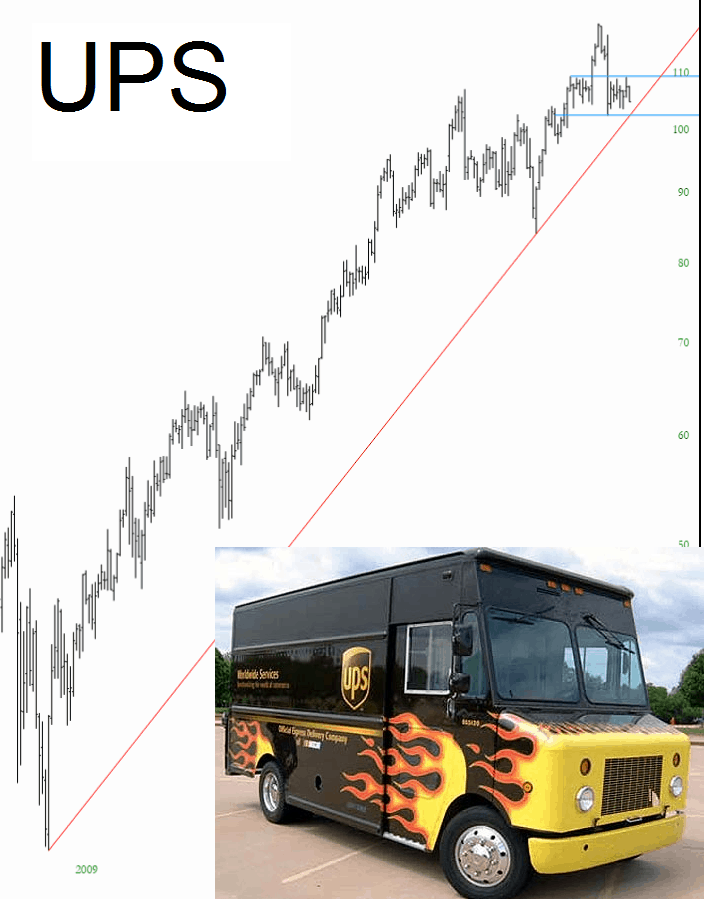

Here’s a chart that has managed to stay bearish even in the La-La-Land environment we are in: United Parcel Service.

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Here’s a chart that has managed to stay bearish even in the La-La-Land environment we are in: United Parcel Service.

Short term rising channel support was broken at the lows on SPX yesterday, and that break was confirmed with another break below this morning. My working assumption is that SPX is now in a topping process for the final move into the swing high that we are looking for here, and it’s possible that swing high was made yesterday, though there are good reasons to think that there is still one more new all time high on SPX that I’ll be looking at on the ES chart. In the meantime SPX is still holding the 50 hour MA, currently at 2392.50, as support and while that remains the case I still like the ATH retest. SPX 60min chart:

Green, green, everywhere! Not even complete mayhem in D.C. politics can shake this market. And, hey, SNAP reports after hours, so that’ll hold the entire economy up on its own!

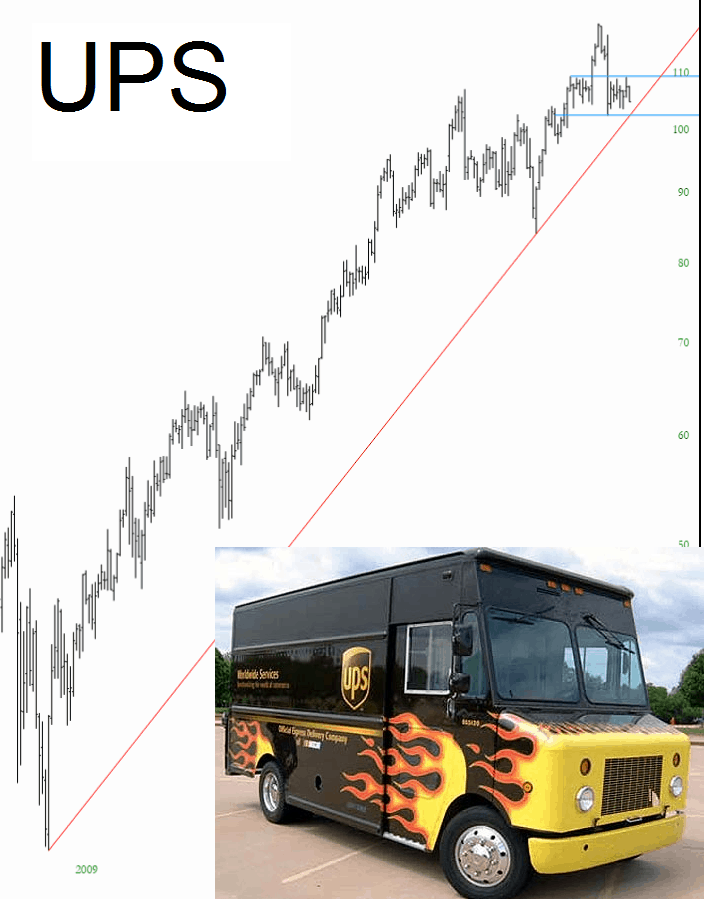

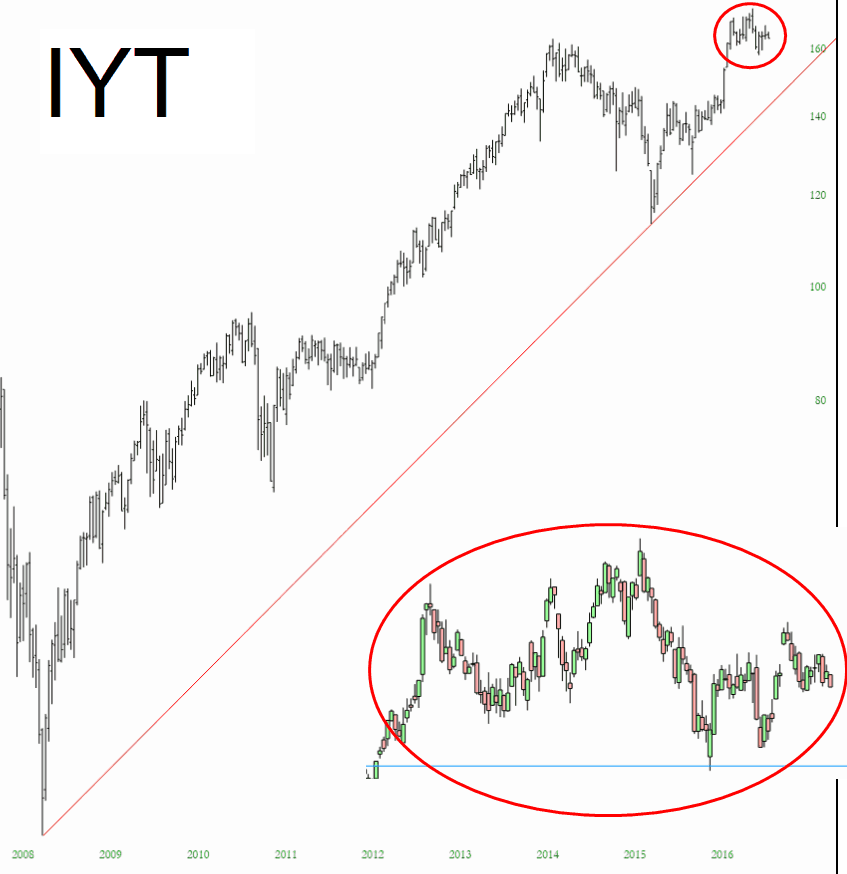

Crude oil has done a good job putting a damper on my day, but I wanted to share one chart of an ETF which still, even in this environment, is an inviting short: the Dow Transports. I’ve shown a close-up view of recent activity (inset…….obviously) below:

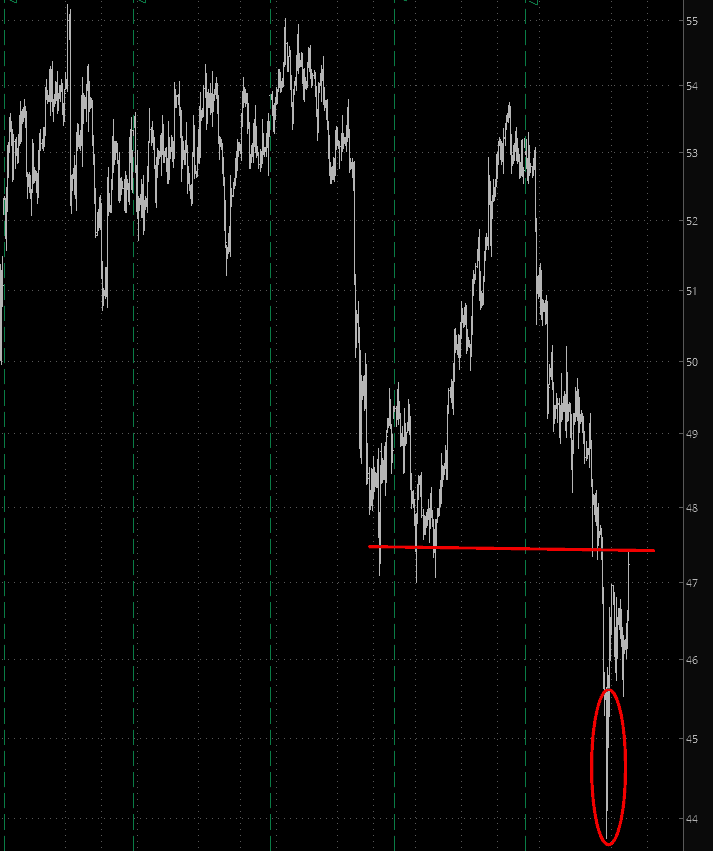

Well, the weekly inventory report came out, and the substantial inventory draw sent prices ripping higher (as I’m typing this, the front month is up nearly 3%). This isn’t great for me, due to my focus in energy shorts, but I actually only have one position in my portfolio in the red, so it’s not too bad. I did trim my ERY long position by about 35%.

My view is that oil sort of flushed out the stops a few days ago (red circle) and it’s recovering from that. However, there is a massive wall of overhead supply (see red horizontal line) that I think will be a strong boundary to further upside.

In the short time I’ve been typing this, crude’s rise has faded to 2.75%, so I’m thinking maybe we’ve already see today’s high.