Well, the weekly inventory report came out, and the substantial inventory draw sent prices ripping higher (as I’m typing this, the front month is up nearly 3%). This isn’t great for me, due to my focus in energy shorts, but I actually only have one position in my portfolio in the red, so it’s not too bad. I did trim my ERY long position by about 35%.

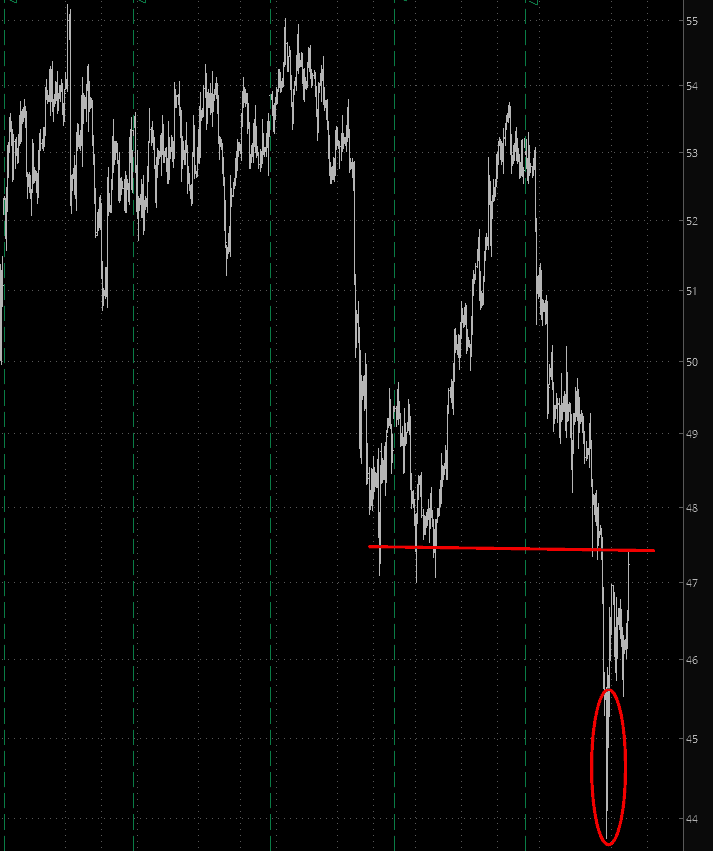

My view is that oil sort of flushed out the stops a few days ago (red circle) and it’s recovering from that. However, there is a massive wall of overhead supply (see red horizontal line) that I think will be a strong boundary to further upside.

In the short time I’ve been typing this, crude’s rise has faded to 2.75%, so I’m thinking maybe we’ve already see today’s high.