The retracement that I was talking about yesterday has been happening, but not quite as I expected, and while I'm still leaning bullish here, that might change today. On ES a little H&S has formed from the high and that has already broken down with a target at 1435. I said yesterday morning that my bull/bear line was support at 1444.5 and that's still true, but the likelihood that will be broken has increased considerably since then:

On the SPX 60min you can see the negative RSI (14) divergence that I was talking about yesterday morning, and you can see that another little H&S has formed there as well since then. It's worth noting too that the W bottom target was at 1462 and that has of course been reached. I'm seeing key support in the 1450 SPX area here, which fits with support on ES at 1444.50.

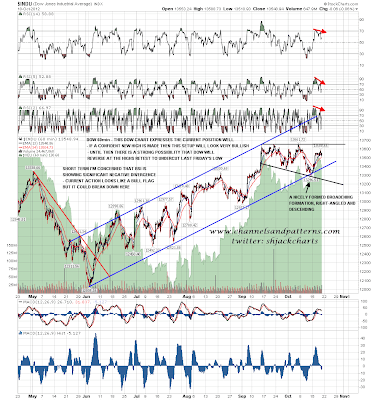

Once again the Dow 60min chart expresses the current position well. The obvious target is a retest of the highs, and the action over the last day looks like a bull flag to get us to that test. The negative RSI divergence is a concern however and we could break downwards here. 60min RSI divergence this definite tends to be seen at short term swing highs and lows of course:

The little H&S I was looking at on EURUSD yesterday morning broke down and has made it most of the way towards target. I have trendline support in the 1.302 area and level support in the 1.30 area. A break below 1.30 with any confidence would look very bearish and would most likely drag equities down with it:

I haven't posted the CL chart for a few days as it's essentially been dead in the water. That hasn't changed yet, but during this period a decent short term rising support trendline has been established, and a break below that would look significant. Until we see that happen the IHS forming on CL has me leaning bullish and if we live long enough to see CL break over 93.7 with any confidence the target would be in the 100 area:

I've been considering the AAPL chart on various timescales. The little double-bottom that broke up the other day failed badly shortly afterwards,and the setup on the daily chart looks very bearish still. The still unresolved H&S is targeting the 590-600 area, and the rally held the broken neckline on a daily closing basis while forming a bear flag. Support was found at the 100 DMA but the obvious target in this context is the 200 DMA in the 580 area. AAPL might well be a buy there, but it's still a sell here:

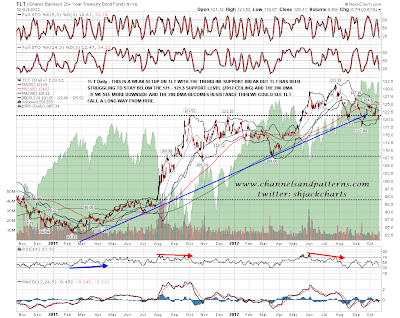

I've also been looking at the bigger picture TLT chart, as the double-top setup I have been watching has now definitely broken down. You can see that TLT has been struggling to get below a combination of the strong support level at 121.50 and the 200 DMA in the 120 area. It's worth noting here that this looks like a major bull/bear dividing line. If TLT breaks support with any confidence it will be in a bigger picture bear move with an obvious target to my eye at strong support in the 108 area. That would have big implications and I'll be watching TLT carefully:

The obvious upside target for the move this week has not yet been reached, but the bear side is looking more compelling. I would normally count a move on SPX to within 5 points of the daily upper bollinger band as a hit, and we saw that. The sort of negative RSI divergence here is normally seen at short term swing highs or lows. H&S patterns have formed on ES and SPX. If we see breaks below 1444.50 ES and 1450 SPX then the bear view that we are back in a short term downtrend of unknown duration will look very compelling, so I'll be watching those levels. A breakdown on EURUSD would also not help the bulls and I'll be watching the support levels at 1.302 and 1.30. until then I'm still favoring another move up into range resistance on ES, SPX and Dow, but with much less confidence than I was on Wednesday or Thursday morning.