The broad market advanced .73%. Much is being made of how January starts as a great prognosticator for the balance of the year. Statistics for the first week in January and what that bodes for the entire market abound, along with analogs, ideologues and all manner of other 'stuff'. History repeats, rhymes, and more often reminds that we never step into the same river twice, but most times our feet will get wet, sometimes the river has run dry and sometimes we just might drown. I find that to be a useful mental model as an antidote for over generalizations and wild prognostications.

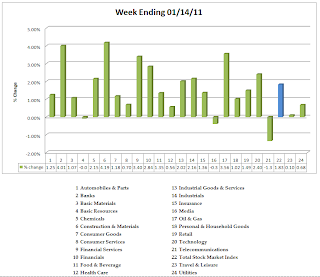

Here is how the major sectors performed (click on all images for enhanced viewing):

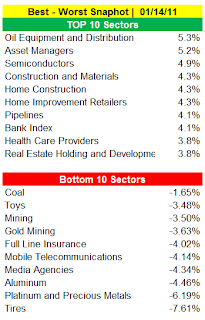

From the subsectors, here is a view of the best/worst performing areas:

I have created a chart book for you which you can find here. Asset Managers is the second best subsector. Let's take a look at the sector chart:

There are many constructive charts in this space (so long as the market remains hospitable!). I created a chart book for you for the names in this space for those interested. You can find it here.

Let's close with looking at the broad market chart. I'm including both a weekly and a daily chart.

The weekly chart remains in the overbought area. On the daily chart, the daily is making a new high without the oscillator–a bit of negative divergence. As you can see from the broad sectors, money is moving into new sector leadership…and so long as this broad index moves up, that also denotes new money coming in.

I wish you good trading this week.