The January Macro Update is a bit late this month as I've been slammed and have also been writing the 2011 Outlook and other posts. I think we are in a very critical time for the markets so it is probably good that I've delayed posting this till now.

TOTAL RAILS – http://railfax.transmatch.com/

Nothing new here, total rail traffic is an entire shift higher over 2010 levels.

RAILS – AUTO SHIPPING –

Autos continue to be an area where we must be alert. Shipments are at 2010 levels now and all the "recovery" has not been absorbed. Perhaps the restocking is done and all of those great numbers reported by GM were the normal games played by car makers and dealers. Is it time to short GM? Admittedly, I have already been short GM several times last week. If I have time I'll post a few charts on that stock, it looks like a great set up.

RAILS – SCRAP –

Similar to the tonnage of autos, scrap shipping is in decline. The next month seasonally looks like we will have a tick up, if we don't we need to be looking for this to bleed into other areas of the economy.

CERIDIAN / UCLA FUEL INDEX – http://www.ceridianindex.com/

In the chart below we see that there are two data points that are lower and only one higher. Let's dig into which is which. First the UCLA Fuel Index (PCI) is reported lower again for November, the Industrial Production numbers too declined, but once again the Dow keeps moving higher. Before we get too worried, the December release of the Fuel Index is significantly higher at a 109 level so the year end surge in Christmas stocking could have done the trick. I'll continue to monitor this.

HOUSING – http://www.realtor.org/research/research/ehsdata

No real change in housing. I continue to expect a further decline of 5% to 10% for the year of 2011. As interest rates rise we will see yet another hindrance to the healing of the housing market. In another event, GMAC was force drop cases against 10,000 foreclosures that were in process due to robo-signing debacle. I bet that will help the housing market? Karl has been on top of this and I won't go into any of this and repeat him. http://www.market-ticker.org/akcs-www?post=177483

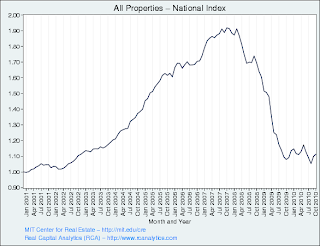

MIT / MOODY'S TRANSACTION PRICING – http://web.mit.edu/cre/research/credl/rca.html

A little move up in CRE transaction pricing. All is good right?

MONSTER.COM JOB INDEX – http://about-monster.com/employment-index

The Monster.com Job Index information was released and we continue to see a decline in the number of on-line job offerings. Jobless numbers have been coming in higher than expected so we certainly need to keep an eye out for any continued weakness in the job numbers.

FOOD STAMPS – http://www.fns.usda.gov/pd/34SNAPmonthly.htm

Nothing new here, more and more folks coming to our government for assistance with basic needs. For the month of October 300,000 more people were added to the roles. Now it is critical to note that this increase is the lowest monthly percentage increase since February of 2010. Hopefully the rate of change will continue to decline.

SCRAP METAL COMPOSITE INDEX – http://www.scrap.net/cgi-bin/composite_prices.cgi?id=100000&num=5

Not anything unexpected, scrap prices continue higher.

COPPOCK TURN INDICATOR –

The Coppoock Turn is still signaling a decline and would continue to do so until the DJIA marked 12,350. While this may be a great long term indicator, you'd have missed almost 1,800 Dow points since June of 2010. Now ultimately it may be correct, but I wouldn't hang my performance on this. I'm continuing to post it here just to watch it and see what happens.

6 MONTH EURIBOR – http://www.homefinance.nl/english/international-interest-rates/euribor-interest-rates.asp

Euribor rates continue to climb – Everything all better in Europe? I think not.

FINANCIAL CONDITIONS INDEX – http://www.bloomberg.com/apps/quote?ticker=BFCIUS:IND

The Bloomberg Financial Conditions Index is now fully over zero which signals an expansion. Happy Days Are Here Again! The move over zero indicates that the US economy is in an expansion, not a recession.

BALTIC DRY GOODS SHIPPING INDEX – http://www.bloomberg.com/apps/quote?ticker=BDIY:IND

The Baltic Dry Goods Shipping Index continues to move lower. I'm convinced that this is the result of over capacity in the shipping industry. Another thing that comes to mind is that there are rumors that business men and regular folks in China have been hording metals ranging from copper, iron, and more IN THEIR BACKYARDS! I'm suggesting that we may be at the level where speculation has run its course and the BDI could be signaling that there is no real demand.. Of course the floods in Oz can't help as coal and other commodities certainly didn't get put on boats in the last week or so.

USD – http://www.bloomberg.com/apps/quote?ticker=DXY:IND

What's that? The USD is starting to fall again? Who would have thought that might happen? Perceived threats to the Eurozone may have been fixed for another month or so and now we see that the dollar has continued its slide.

TRADING UPDATE

The market continues to move higher but signs of topping are certainly unfolding. As I mentioned last week in the 2011 Predictions note I fully expect some kind of correction here, but a final move higher into the end of April and May. Having said that, markets do look toppy.

Specifically, I remarked above that I had been shorting GM all last week and I'll post the chart here. I didn't annotate it here because there is no reason to. You can clearly see that $39.00 was a point of overhead resistance. This could easily drop to $35 in a simple overall market correction and that is how I've continued to play it. Any move above $39.00 will stop me out.

Metals have been weak too as the ECB and Eurozone look to have solved all of their problems……(not). Other than the agriculture areas that I highlighted in the 2011 Outlook, I also said that energy would be a place of great gains. I mentioned XLE, and KOL, but I want you to examine UGA (gasoline). If there is truly a trade for the first half of the year other than the "softs" I think gas is it. I'm not writing about natural gas as I hate the eft for it has been a killer for anyone holding it long term and many of you kow that I am fond of calling UNG the widow-maker I am referring to the gas in your cars. We have punched above old resistance at $40.00 and now I can see UGA move to $52.00 or higher as we get into the summer driving season.

Finally, here is another view of UGA as it shows the 14 day EMA and the 40 day EMA. This is a longer term indicator I use to show breakouts and breakdowns. The crossing over of the 14 day EMA on this weekly chart shows that there is a lot of momentum here. (Wish I would have been watching for this back at $36.00). Also the CCI is showing that the trend is absolutely in the bullish camp. A drop below 100 would tell us the momentum is gone.

In closing, overall macro trends are mixed to positive, but I think the trader's technical set up is one for a correction. Despite the negative feelings I have, the indices continue to push higher and higher even though individual story stocks are pretty nasty. I made great money shorting last week with a major gain in shorting the rare earth element companies I've mentioned recently. Earnings announcements for the last couple of quarters have been a "sell the news" event, so that too gives me more confidence to be on the short side. Still, blindly shorting will probably yield the same results that we've seen for the last 18 months, so you need to target weakness and sprinkle in a little luck. Perhaps that is what many shorts will receive today as I note that Steve Jobs is taking a leave of absence and the wonder company AAPL is down pretty big in Germany and Europe (market is closed in the US today). This may provide the catalyst for the short term correction I've been looking for in the broader market, but I firmly believe that the dip will be bought and that is what I'll be doing in the areas I identified in the 2011 Outlook.

I'll leave you with one other chart here to underscore what I mean when I am looking for a correction. As I noted in last week's outlook several indicators have signaled just how overdone the rally has been without any hint of a reversal. Market breadth, put/call rations, AAII investor sentiment, and more show that bulls are not only complacent, they are outright crazy bullish. Times like these require, no, I mean demand some sort of adjustment to reign in the euphoria. I've often included work from my friend Guy Lerner from www.thetechnicaltake.com Below is a simple chart that reflects how bullish his investor indicator is (bottom portion of the graph – red line) and how this suggests that we should see a sizable correction (holding breath waiting now….). Guy's work is always great and I highly recommend his paid site, it provides super information and is really cheap on the wallet.