Such a day in the market on Friday! The unrelenting march forward was stopped and then pushed back. For the week, though, the change was merely a .35% decline. However, looking at the sector/industry charts, you will note that that there has been some serious damage done to these charts. Drilling down to individual stocks, the carnage is even more brutal.

We must be ever cognizant that market indices are like a house which goes up brick by brick. For an index, the bricks are individual stocks and their collective performance. An index house will eventually roll over once the sector bricks are weakened one by one–but that rolling over is through a successive failures in stocks/sectors. That is why topping is a process. And while the market tops over a period of months (e.g. Financial topped in Feb of 2007 (in fits and starts); Basic Resources topped a full 16 months later), they all seem to bottom at the same time, with October 2008 and March 2009 a collective double bottoming for every sector. I've been providing a view of the total stock market index.

Let's take a look at that daily chart here (click all images for enhanced viewing):

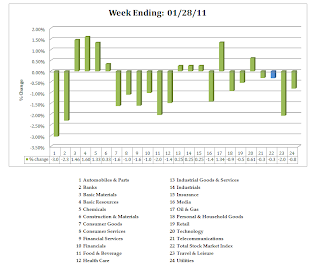

As we can see by the volume@price bars, we have quite a bit of price memory here. Note that the last peak is at the bottom of the bar which would offer the next range of support with some worrisome vacuum underneath. How did our sectors fare over the week?

Here are the top/bottom ten performers at the industry level (This is weekly only):

In days such as yesterday when all the world is going to hell (or seemingly so), spotting divergences is informative (for those of you that trade individual securities v. indices). For those of you inclined that way, this weekend is a good time to review that information which you can do easily on FINVIZ (though I have prepared my usual report for you which you can find here):

- Industry subsector performance: You can find the industry subsectors here. (sorted in best to worst). If you like to see this information graphically, you can do so here.

- Individual stock performance: You can find individual issues here (sorted best to worst)–be sure to use the filtering tools to pull out thin capitalizations and low priced stocks–a graphical rendition is found here where you can see the sector + individual notables (the good, bad and the ugly).

- Short interest change: You can the change in short interest (in addition to the total short interest here.

- Relative Volume: Viewing sectors by relative volume can also be fruitful. You can find that view here.

Let's see where the short interest changes are:

Whether we had a healthful consolidating pullback or something more will be determined with the passage of time. Many of the sector leaders (e.g. automobiles/parts) have been weakening over the past couple of weeks. Price action has moved ahead of the news. News is now coming out that informs the correctness of the market's anticipation of future events.

The market by its nature is anticipatory; however, we should always remember that its crystal ball is cloudy. It does act decisively when its expectations are not met. We should as well. I wish you good trading for next week, and I hope that that you find some use from this week's report.