I've been looking over a lot of charts this morning and have been considering the case for a major top at last week's highs. It seems too early still, but there's no doubt that a number of significant trendlines were hit, both long and short term, and the high wasn't far from the 78.6% fib retracement of the bear market in the 1380 area. On a trendline basis SPX has made a fourth touch of what now looks like a very significant rising resistance trendline. We'll have to see, but until SPX breaks that trendline with some confidence this is a higher risk area for longs, and we're now in the traditionally weaker May to October period of course:

Shorter term on the SPX 60min chart an obvious shorter term reversal area was also hit, with the obvious reversal targets at the retest of the IHS neckline at 1343ish, or rising (possible rising wedge) support in the 1320 – 1330 area:

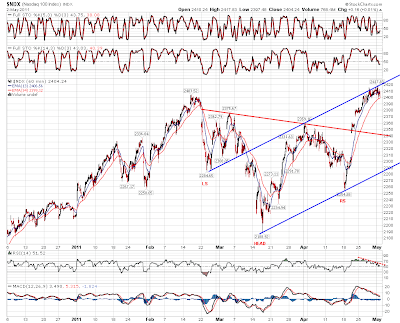

On the Nasdaq an obvious rising channel resistance trendline was also hit. The IHS on NDX is downsloping, so a retest would require a larger drop to the 2340 area if we were to see that retested:

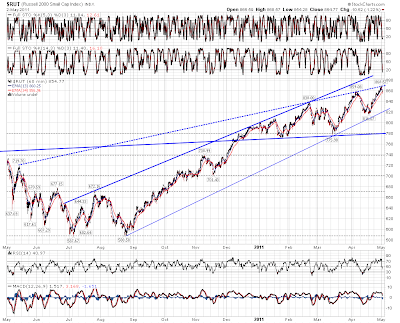

Looking at the Russell 2000 on a longer one year timescale it too has made a fourth touch at a now very significant looking resistance trendline:

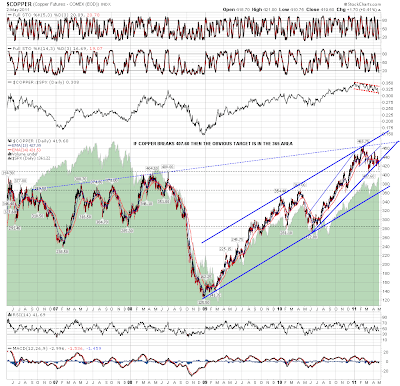

A number of the traditional indicators have already reversed of course. Bonds made what increasingly looks like a major low at the end of January, and show no sign of reversing back down. Copper too made a major high in January, and the obvious target now is major support in the 365 area, though there's still decent support in the 407.6 area:

I was looking at the Vix chart this morning and there's a possible double-bottom in the 14.3 area there. The island top indicating to 14.7 has already played out to target. Island tops are poor performers unless the top is high and narrow and this one is a classic example of one of those. Short term, we could see a significant reversal back up on Vix here:

On precious metals there's also a good case for a short term top here. On my gold monthly chart gold broke long term resistance, which opens the way to big further moves up in the future. Short term however gold hit the upper trendline of the rising channel from the November 2008 lows, and a retracement to channel support looks likely. There's excellent support in the 1430 area so that might well be hit with channel support in a couple of months:

Short term I'm looking mainly at the IHS on SPX for direction here. If the neckline holds then the bull case on SPX here still looks healthy, but if it breaks I'd be inclined to write the IHS off and rely on the other patterns and channels on SPX and NDX. It's a continuation IHS in any case, so I'd give the pattern less weight than a classical reversal IHS. IHS neckline support on SPX is in the 1343 area and rising wedge support is in the 1320 area if the neckline is broken.