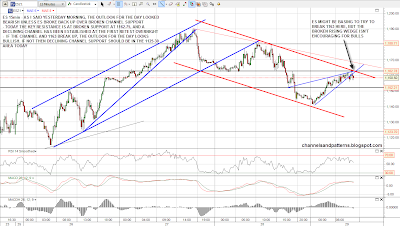

Just a quick post today as I've been overdoing it a bit since I returned from vacation and I'm feeling a bit washed out. The trendline setup today looks pretty simple today in any case. As I said yesterday morning, the ES rising channel breach and retest looked bearish unless ES broke back up into the channel and we duly had a down day on SPX. A declining channel has since formed since the high this week and immediate resistance is at the broken 1162.75 level (ES). That has been tested and the declining channel established at the overnight high. If 1162.75 resistance and the declining channel hold today then the outlook is still bearish with declining channel support in the 1125-30 area today. If we see a break up through the declining channel and 1162.75 then the outlook will turn bullish and we might see a significant rally today. Here's the setup on the ES 15min:

The end of the month and the quarter are tomorrow of course, and this is a moment of truth for one long term indicator, which is the monthly 20 SMA on SPX. As you can see from the chart below this has been support in bull markets and resistance in bear markets over the last 16 years. In the last two bear markets after the monthly close below the 20 SMA the line was not crossed again until the next bull market so this is worth watching and the level is at 1206.26 today. This is my chart but I first saw this long term indicator at Breakpoint Trades. They do excellent charts and writeups every morning and weekend and supply an outstanding service in my view. If you're interested in trying them out then they have a sale price offer on at the moment. I don't have any arrangement for promoting them but if you were thinking of signing up then you could throw my pal Steveo a bone by signing up via this link from his blog. I wouldn't get anything for that, I'm just mentioning them because I think they provide an excellent service at a very reasonable price. Here's the SPX monthly chart:

I was talking about the possibility of a sizable multi-week rally yesterday, and that possibility looks weaker today unless we see a very strong move up in the next two days. Are the bears entirely (as it were) out of the woods yet? Not yet no. I posted the chart below on twitter yesterday showing a very bearish setup on 30yr treasury futures that would look bullish for equities if it played out:

That's looking more encouraging this morning, with ZB back up over the neckline, the declining channel broken, and retesting the broken rising support trendline. A failure here would still look bearish for bonds and bullish for equities, but if ZB breaks back up over the neckline then we might have a failed support break suggesting a strong reaction rally. If we see that I'm considering the possibility that an IHS might form with 142 resistance as the neckline:

I mentioned that a big declining channel was established at the silver futures (SI) low, and here is that channel. We might well see silver rally further within it:

Copper futures (HG) made a new low yesterday which looks bearish. The closing low also established a big declining channel on copper, but unlike silver copper pinocchioed through channel support before closing back there. Copper looks likely to bounce a bit here with this support hit and some positive RSI divergence at the low, but a rally to channel resistance seems unlikely:

I'm leaning bearish on equities today unless ES breaks back up over 1162.75 resistance.If it does break back up over that resistance there's the potential for a strong gap up and go rally today.