Well I missed a boring trading day yesterday it seems, but from a technical perspective it was interesting. On my SPX 15min chart I'm seeing strong positive RSI divergence at the low and a poor quality IHS mostly formed. I also have a declining channel with channel resistance in the 1380 SPX area today:

I was talking about bearish reversal patterns in one of my posts last week and there are three main ones to watch here in the short term, as well as quite a number of larger H&S patterns that are getting close to completion, some of which I posted last week. I've posted the possible sloping H&S on SPX before and that's now looking pretty good, with the neckline slightly above yesterday's low as it is sloping up. The target for this H&S would be in the 1290 area and I'm now taking it very seriously, though I've said before that I prefer H&S patterns with horizontal necklines:

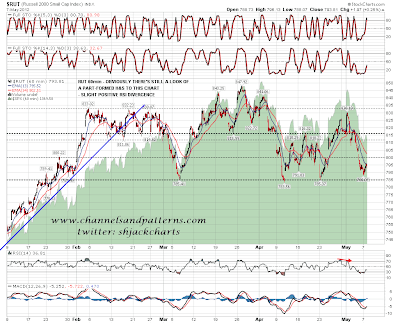

I've posted the possible H&S forming on RUT a few times and that too is looking pretty good here. The neckline is at 785, and the H&S target would be in the 720 area on a break below that. Again I think that this is worth taking very seriously:

Possibly the key pattern though is the H&S on EURUSD. I was saying yesterday morning that it was still very much in play and that I was watching to see whether the rebroken neckline would now act as resistance. As you can see that was retested perfectly yesterday. This strengthens that H&S setup a lot and unless EURUSD can recover and hold that broken neckline I would be looking for a move to the target in the 1.27 area very soon. Given the news from the Euro area that would also of course make excellent fundamental sense here:

I've been regarding the chop over the last few weeks as a wave 4 move before a last wave up into the 1442 SPX pivot or higher. Given the technical setup here that may well not be the case, and if we see those H&S patterns on SPX and RUT break down, then we may well see them reach target very soon, much as we did when the topping H&S patterns broke down last summer. Below those necklines is a level to be extremely cautious on the long side in my view.

Short term I'm leaning towards seeing some more bounce today on SPX and I think we may well see a move to test declining resistance in the 1380 area. Yesterday's low is support, and if that's broken with any confidence I would be leaning bearish, looking to channel support in the 1350-5 area and next key level support at 1340 SPX. On a conviction break below 1340 I have the next important support at 1292.66, very close to that H&S target, and I would be leaning very strongly bearish.