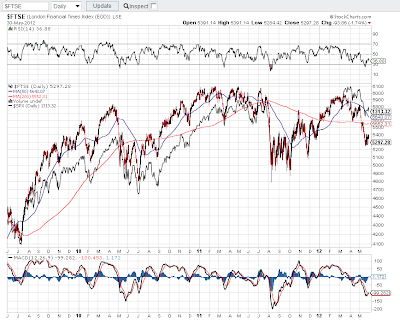

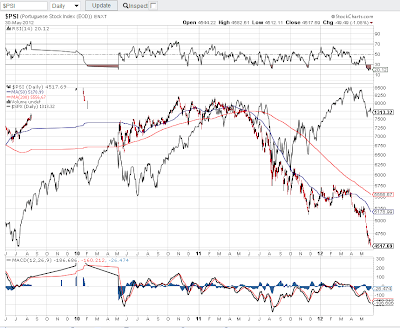

Below are a series of 3-year Daily charts comparing the performance of the main European stock indices with the SPX.

GERMANY: Price has moved fairly lock-in-step with the SPX, although it weakened more in the August 2011 drop and has remained weaker.

FRANCE: Price has moved fairly lock-in-step with the SPX, although it weakened more in the August 2011 drop (and a bit more than the DAX) and has remained weaker.

LONDON FTSE: Price has moved fairly lock-in-step with the SPX, although it weakened more in March of this year and has remained weaker.

SPAIN: These have taken turns leading, but Spain weakened considerably beginning in May of 2011 and the weakness has accelerated.

ITALY: These have taken turns leading, but Italy weakened considerably beginning in May of 2011 and the weakness has accelerated.

PORTUGAL: These have taken turns leading, but Portugal weakened considerably beginning in July of 2011 and the weakness has accelerated.

GREECE: These have taken turns leading, but Greece weakened considerably beginning in December of 2010 and the weakness has accelerated.

In summary, the "periphery countries" (Spain, Italy, Portugal, and Greece) have been more volatile in their trading during the past three years as their swings above and below the SPX have been much wider than their "core country" counterparts (Germany, France, and England). The "periphery countries" are all trading well below their opening price from three years ago, are at three-year lows, and are trading under bearish moving average "Death Cross" influences…Greece has been in a downtrend since November of 2009. I'll be watching over the next days/weeks for signs of a bearish "Death Cross" to form on the "core countries"…one could form in the next few days on the French CAC, followed by one on London's FTSE. All of them have downtrending RSI and MACD indicators, which haven't been broken to the upside.

All of them are weaker than the SPX at the moment, the weakness is accelerating on the "periphery countries," and it has recently begun to accelerate on the French and London indices, and, to a lesser extent, on Germany's index.

I expect further weakness in all of these indices (including the SPX) until I see evidence of a reversal of price and indicator trend, a retest, and a subsequent rally with the backing of powerful financial, monetary, and fiscal cohesiveness…until those materialize, I doubt we'll see much of a sustainable rally.