I was explaining yesterday morning that the setups and statistics for this week meant that the ball was with the bears at the start of this week, and it's starting to look as though they immediately dropped it. This might just be another pre-retracement bounce but the odds have definitely been shifting in the bulls' favor into this morning:

I was saying yesterday morning on twitter that if we were to see a bounce on TRAN then the obvious target would be at declining resistance from the high, which would be the resistance trendline on a 55% bullish broadening descending wedge. If we see that hit today, and at the moment that looks more likely than not, then we would probably see some resistance there regardless, but the larger move would be either to break up or to reverse back down into wedge support. A break over followed by a strong reversal down would look like a bearish overthrow that might well then precede a larger break downwards. This is an important chart to watch today:

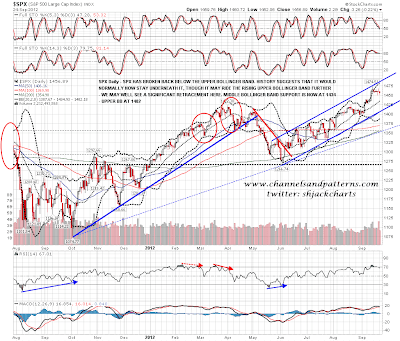

On the SPX daily chart these sideways moves have been increasingly looking like a bull flag. I would be surprised to see another break much over the upper bollinger band next but that's at 1482 now so there's some upside room within it:

ES is moving back towards the top of the trading range at 1462 and looking at TRAN, EURUSD and oil there's a good chance that will be tested today:

EURUSD has most likely made a short term swing low and is starting another move up. Not definite yet but the marginal lower lows are bullish, and the current low at 1.2885 is just about close enough for a retest of the 200 DMA in the 1.283 area. There are two possible W bottoms in play there, the trigger levels and targets are on the chart, and there is also declining resistance in the 1.298 area to bear in mind:

Again on twitter I was saying yesterday before the open that CL needed to break below 90 to avoid a bottoming setup there. It didn't do that and here is that very nice looking bottoming setup. The double-bottom target will be the 95.7 area on a break over 93.85:

I'm leaning long today into a test of the range top on ES at 1462 and the wedge resistance on TRAN in the 5000-10 area. EURUSD and CL are telling us that the moves on equities may well not stop there. If we see ES and TRAN break up I would expect that to follow through, though on ES and SPX in particular, any break above the current highs would need to be with some conviction to avoid topping setups developing there. Any marginal new highs would be on significantly negative RSI divergence on the daily charts.