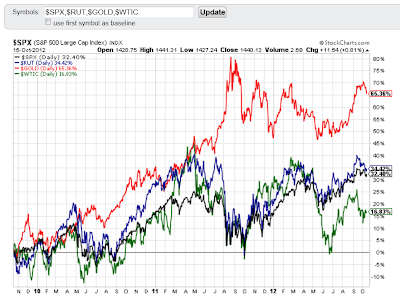

I thought I'd look at the S&P 500 and Russell 2000 Indices, Gold,

and Oil to compare where they are trading on a 1-Year Daily timeframe

relative to their 50 sma and on a 3-Year, 1-Year Daily, and 11-Day timeframe

relative to each other.

The first chartgrid shows a 1-Year

timeframe, with the SPX and RUT trading around their 50 sma, Gold is

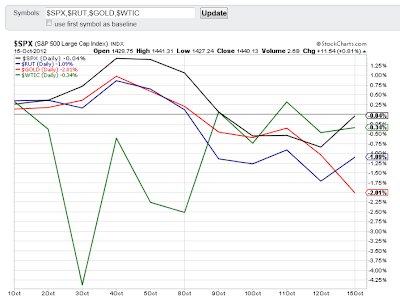

above its 50 sma, and Oil is below its 50 sma. The second chartgrid shows a

2-Month close-up shot, with today's recovery into the close on

the SPX, RUT, and Oil. Gold closed near today's low. While the SPX and RUT have

made a new high during the past year (which is serving as near-term resistance,

thus far), Gold and Oil have not. The triple top on Gold at 1800 is serving as

major price resistance, while the 100.00 level is holding as major price

resistance on Oil (with the 50 sma holding as near-term resistance at

93.96).

The 1-Year

percentage lost/gained graph below shows that the SPX leads in

percentage gained, followed by the RUT, Oil, and Gold.

The 1-Year

comparison chart below shows that, on a relative-strength basis and in

price-action format, the SPX has gained the most over the past year, followed by

the RUT, Oil, and Gold.

However, when we look

at a 3-Year comparison chart, we see that Gold is, by far, the

leader, followed by the RUT, SPX, and, finally, Oil.

Finally, this last

comparison chart shows price action for the month of

October, thus far. Gold has seen the most profit-taking, while the SPX,

Oil, and RUT have seen the least and have turned up slightly the past two days.

Whether this is an indication that traders are taking profits in Gold to

fund further buying in equities and, possibly, Oil, remains to be seen.

This can be tracked over the next few days/weeks for confirmation of such a

scenario.

In any

event, the 50 sma is having an impact on price action on the SPX, RUT,

and Oil. Should all four instruments break and hold below this moving average,

we'll likely see a correction in equities and commodities, in

my opinion. I'll be looking for confirmation of this in short-term price action

on the OEX, DBC, the U.S. $, and 30-Year Bonds, as mentioned here

and here.